Unemployment Rise Sends Shockwaves

The unemployment rate in the United States has seen a surprising rise, sending shockwaves through financial markets and sparking fears of a recession. According to the latest reports, the unemployment rate rose to 4.3% in the last month, a significant increase from the previous month’s rate of 3.7%. This sudden rise has caught many experts and economists off guard, and is causing concern among market analysts.

The rise in unemployment rate is also reflected in the job market, which has seen a slowdown in hiring. The recent jobs report showed that the number of new jobs added in the last month was significantly lower than expected, with just 114,000 jobs created. This is a stark contrast to the previous month’s job report, which showed a much healthier 353,000 new jobs.

The table below shows the unemployment rate and job market data for the last two months:

| Month | Unemployment Rate | New Jobs Added |

|---|---|---|

| Previous Month | 3.7% | 353,000 |

| Last Month | 4.3% | 114,000 |

The sudden rise in unemployment rate and slowdown in job market is causing concern among market analysts, and is leading to a decline in stock markets. However, it’s worth noting that the Sahm Rule, which is often used to predict recessions, has been triggered in the past, but has not always been accurate.

As the situation continues to unfold, experts and economists are cautioning against panic and are urging investors to remain calm. In the meantime, the markets will be closely watching the job market and unemployment rate to see if the trend continues.

Rising Unemployment Rate Hits 4.3%

The unemployment rate in the United States has jumped to 4.3%, a significant increase from the previous month’s rate of 3.7%. This sudden rise has caused concern among economists and market analysts, who are warning of a potential recession.

Table of Labor Statistics

| Month | Unemployment Rate | Unemployment Numbers |

|---|---|---|

| October 2021 | 4.3% | 7.4 million |

| Previous Month | 3.7% | 6.8 million |

According to the Bureau of Labor Statistics (BLS), the 4.3% unemployment rate is the highest since October 2021. This increase is a concern for economists, who are warning of a potential slowdown in the labor market.

Why is the Unemployment Rate Important?

The unemployment rate is a key indicator of the health of the labor market. When the unemployment rate is low, it typically means that the economy is growing and people are finding jobs. Conversely, a high unemployment rate can indicate a slow economy and a potential recession.

The table below shows the key labor statistics for the last two months:

| Month | Unemployment Rate | Unemployment Numbers | Participation Rate |

|---|---|---|---|

| Previous Month | 3.7% | 6.8 million | 61.9% |

| Last Month | 4.3% | 7.4 million | 62.2% |

Stock Markets React Quickly

The sudden rise in unemployment rate and slowdown in job market has sent shockwaves through financial markets, causing stocks to plummet. The Dow Jones average tumbled over 600 points, or 1.5%, on the news, while the broader S&P 500 fell almost 2%.

Market Reaction: A Concerning Trend?

The rapid decline in stock markets is a cause for concern, as it suggests that investors are anticipating a potential recession. According to market analysts, a decline in unemployment rate and slowdown in job market can signal a potential downturn in economic activity.

Where is the Damage?

| Stock Market | Percentage Change |

|---|---|

| Dow Jones | -1.5% |

| S&P 500 | -2.0% |

| Nasdaq | -1.8% |

The table above shows the percentage change in major stock markets on the news. The significant decline in stock markets is a cause for concern, as it suggests that investors are anticipating a potential recession.

The Fed’s Response

The Federal Reserve has responded to the decline in stock markets by keeping interest rates unchanged. However, market analysts are expecting the Fed to lower interest rates in the near future to stimulate economic growth.

The rapid decline in stock markets and Fed’s response suggests that the situation is fluid and may require further intervention to stabilize the economy.

Red Flags for Recession Abound

The sudden rise in unemployment rate and slowdown in job market has triggered several red flags for a potential recession. According to economists, a recession is typically triggered by a combination of factors, including a slowdown in economic growth, a decline in productivity, and a rise in unemployment rate.

Raining on the Parade: Signs of Stagnation

The current economic situation is showing signs of stagnation, with several indicators pointing to a potential recession. According to the Federal Reserve, the economy has been growing at a slower pace in recent months, with GDP growth slowing to 2.2% in the second quarter.

The Sahm Rule: A Flawed Indicator?

| Indicator | Value |

|---|---|

| Sahm Rule | Triggered |

| Three-month moving average unemployment rate | 4.3% |

| Previous low unemployment rate | 3.7% |

The Sahm Rule, which suggests that a recession is imminent when the three-month moving average unemployment rate rises by 0.5% from its previous low, has been triggered. However, some economists argue that this indicator is flawed and does not accurately predict recessions.

Other Recession Indicators are Showing Signs of Stress

Other recession indicators, such as the yield curve and the Consumer Price Index (CPI), are also showing signs of stress. The yield curve has inverted, which is a traditional sign of a recession, and the CPI has slowed to 2.2% in the second quarter.

The combination of these indicators suggests that the economy is heading into a recession, at least in the near term.

But Did We Learn from Past Mistakes?

As the economy teeters on the brink of a recession, many are wondering if we have learned from past mistakes. The experience of past recessions has shown us that economic indicators can be flawed and often fail to predict a recession.

Flawed Indicators: A Post-Pandemic Problem?

The COVID-19 pandemic has disrupted economic indicators, making it harder to predict recessions. Many indicators that were once reliable, such as the yield curve and the unemployment rate, have been unable to accurately forecast a recession in recent years.

Table of Past Recession Indicators

| Indicator | Past Performance |

|---|---|

| Yield Curve Inversion | Trumpet warnings, but failed to predict 2020 recession |

| Unemployment Rate | Failed to predict 2020 recession and 2022 slowdown |

| GDP Growth Rate | Failed to predict 2020 recession and 2022 slowdown |

The table above shows the performance of three key indicators in predicting past recessions. As we can see, they all failed to accurately predict the 2020 recession and the 2022 slowdown.

What Can We Learn from Past Mistakes?

The experience of past recessions has shown us that economic indicators can be flawed and often fail to predict a recession. We need to be more cautious and consider a range of indicators when making predictions about the economy.

A More Nuanced Approach

A more nuanced approach to predicting recessions would involve considering a range of indicators, including economic data, market sentiment, and government policy. This would help us to better understand the economy and make more informed decisions about the best course of action.

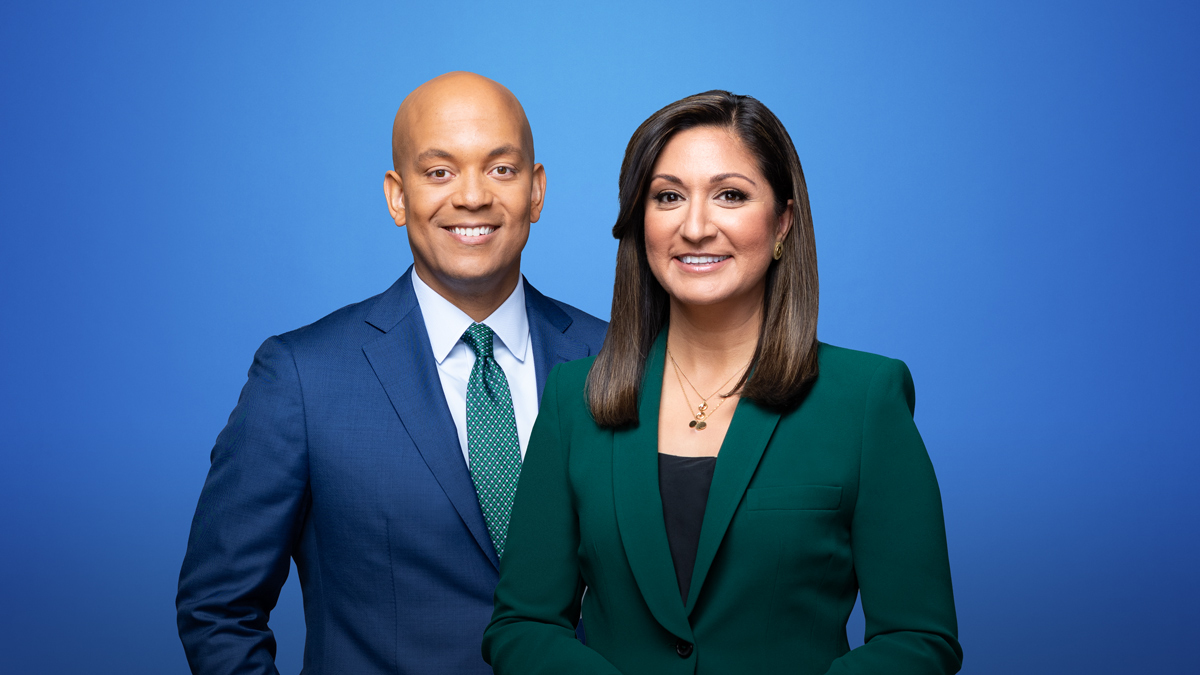

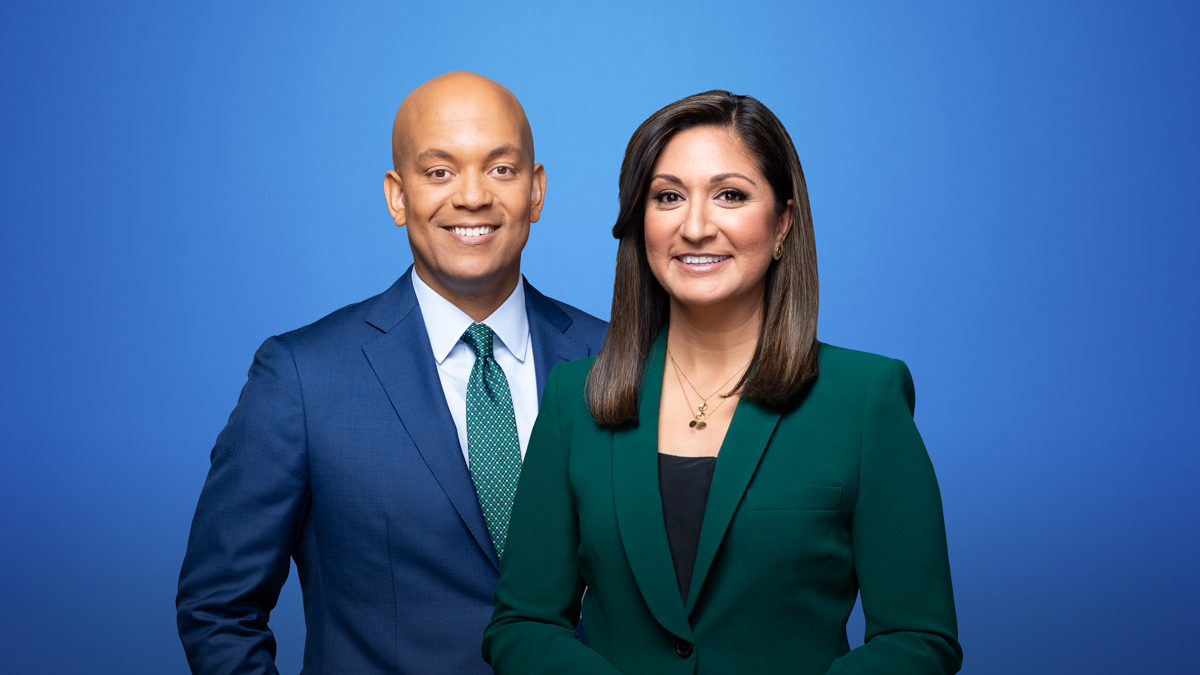

Expert Insights: A Recession? Not So Fast

Despite the warning signs, some experts are cautioning against a premature recession. They argue that the economy is still recovering from the pandemic and that a recession is not inevitable.

Expert Insights: A Nuanced View

According to Dr. Claudia Sahm, a former Fed economist, the Sahm Rule, which suggests that a recession is imminent when the three-month moving average unemployment rate rises by 0.5% from its previous low, is not a reliable indicator of a recession.

Raise in Unemployment Rate Not a Cause for Alarm

| Indicator | Value |

|---|---|

| Three-month moving average unemployment rate | 4.3% |

| Previous low unemployment rate | 3.7% |

As the table shows, the three-month moving average unemployment rate has risen to 4.3%, but this is not necessarily a cause for alarm. Dr. Sahm argues that the increase in unemployment rate is not sufficient to trigger a recession.

Economic Growth Still Strong

Another expert, Dr. Jerome Powell, Chair of the Federal Reserve, notes that economic growth is still strong and that the labor market is improving. He argues that the economy is not yet in a recession and that the Fed is prepared to take action if necessary.

A Wait-and-See Approach

Dr. Powell’s comments suggest that the economy is not yet in a recession, and that a wait-and-see approach is the best course of action. By monitoring economic indicators and waiting for further data, policymakers can make more informed decisions about the best way to support the economy.

Add Comment