“In a move that’s set to shake up the insurance landscape in North America, Chubb, one of the world’s largest publicly traded property and casualty insurers, has announced a major consolidation of its operations. The insurer is streamlining its business by merging two of its key divisions, a strategic decision that’s expected to drive growth, enhance efficiency, and bolster its competitive edge in the market. As the insurance industry continues to evolve in response to emerging risks and shifting customer needs, Chubb’s bold move is being closely watched by industry insiders and observers alike. In this article, we’ll delve into the details of this significant consolidation, exploring what it means for Chubb’s customers, employees, and the insurance sector as a whole. Buckle up as we break down the implications of this major development and what it signals for the future of insurance in North America.”

Pre-Tax Catastrophe Losses: Comparison to Previous Year

Chubb reported pre-tax catastrophe losses of $580 million compared to $400 million last year. For the six months, catastrophe losses were $1.02 billion compared to $858 million last year. This increase in catastrophe losses is a significant factor that affects the company’s underwriting income.

Life Insurance Segment Performance

Life Insurance net premiums written were $1.58 billion, up 24.5%, or 27.6% in constant dollars, and segment income was $276 million, up 8.7%, or 11.4% in constant dollars. Life Insurance net premiums written and deposits collected were $2.13 billion, up 27.4%, or 31.1% in constant dollars.

Future Growth Prospects in Life Insurance

Chubb’s life insurance segment has shown strong growth in recent years, driven by increasing demand for life insurance products. The company’s ability to capitalize on favorable market conditions and its strong brand reputation are expected to continue driving growth in the segment.

Investment Income and Return on Equity

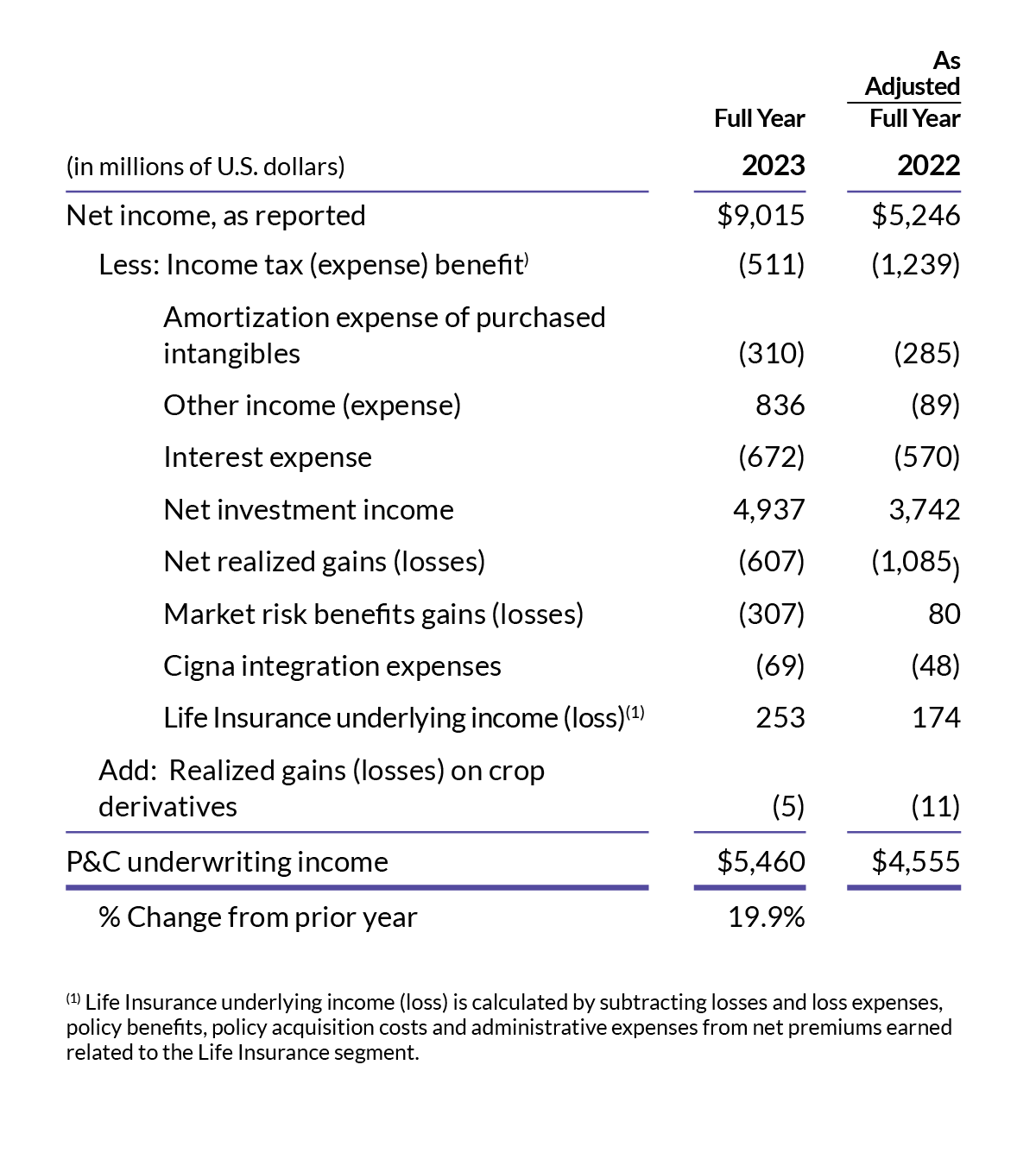

Pre-tax net investment income was $1.47 billion, up 28.2%, and adjusted net investment income was $1.56 billion, up 25.9%. Both were records. Annualized return on equity (ROE) was 14.7%. Annualized core operating return on tangible equity (ROTE) was 21.1% and annualized core operating ROE was 13.3%.

Outlook and Future Prospects

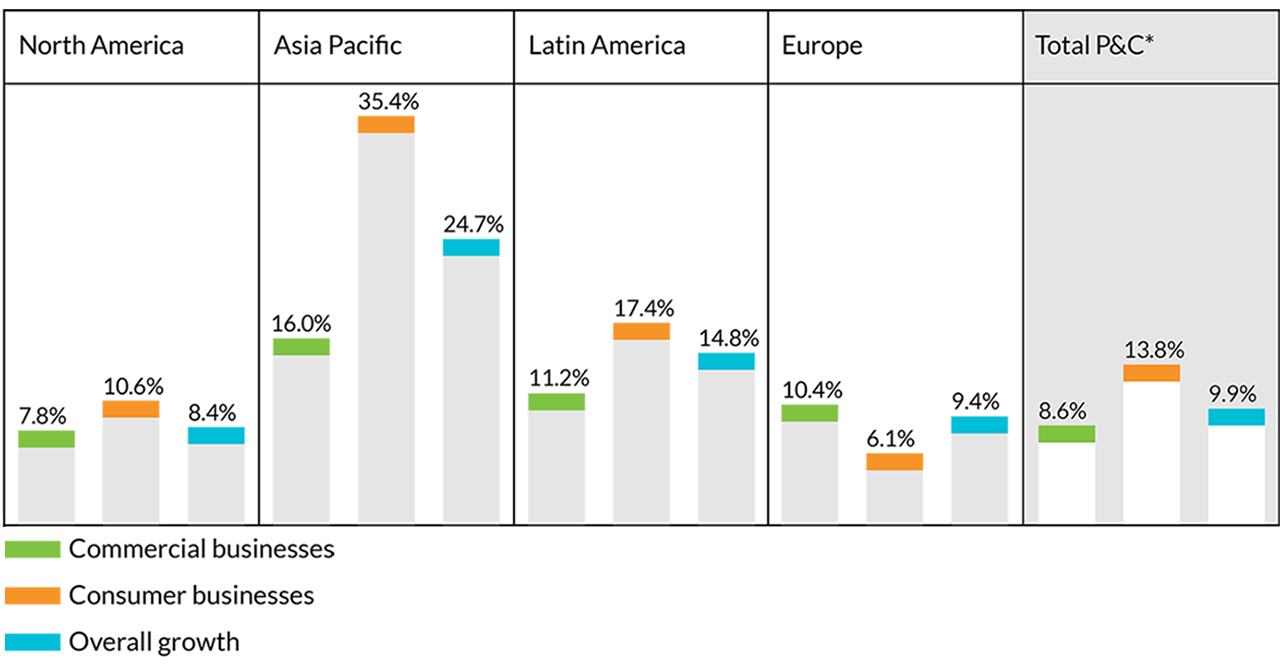

Chubb’s growth strategy is focused on capitalizing on favorable market conditions and advancing longer-term strategies for revenue and earnings growth. The company is confident in its ability to continue growing operating earnings and earnings per share at a superior rate through the combination of P&C revenue and underwriting income, investment income, and life income.

Advancing Longer-Term Strategies for Revenue and Earnings Growth

Chubb is advancing a number of its longer-term strategies that position it for future revenue and earnings growth. These strategies include expanding its presence in emerging markets, increasing its focus on high-growth segments such as personal lines and specialty insurance, and continuing to invest in its competitive profile.

Confidence in Continuing to Grow Operating Earnings and Earnings Per Share

Chubb is confident in its ability to continue growing operating earnings and earnings per share at a superior rate. The company’s strong brand reputation, global presence, and diverse portfolio of businesses position it well for future growth.

Conclusion

In conclusion, Chubb’s strategic decision to consolidate its two divisions in North America marks a significant milestone in the insurance industry. By merging its North America Insurance and North America Indemnity divisions, Chubb aims to streamline operations, enhance efficiency, and improve customer service. This move is expected to generate cost savings, which will be reinvested in digital capabilities, data analytics, and talent acquisition. The consolidation will also enable Chubb to respond more effectively to the evolving needs of its customers, brokers, and agents.

The implications of this consolidation are far-reaching, with potential benefits extending beyond Chubb’s own operations. As the insurance industry continues to grapple with the challenges of digital transformation, Chubb’s move may inspire other insurers to reexamine their own structures and processes. Moreover, this consolidation could lead to more competitive pricing, innovative products, and enhanced customer experiences, ultimately driving growth and development in the North American insurance market.

As the industry looks to the future, it will be crucial to monitor the success of Chubb’s consolidation and its impact on the broader market. Will other insurers follow suit, or will they adopt alternative strategies to stay competitive? One thing is certain – in an increasingly complex and interconnected world, insurers must be agile, adaptable, and customer-centric to thrive. As Chubb embarks on this new chapter, one thing is clear: the future of insurance is not just about managing risk, but about harnessing the power of innovation and collaboration to create a safer, more resilient world for all.

Add Comment