Stability Amidst Uncertainty: Chubb’s North American Expansion In a time when the insurance industry is constantly navigating shifting landscapes and evolving regulatory frameworks, one stalwart player has emerged as a shining example of resilience and adaptability: Chubb, the global leader in insurance risk management. With a rich history spanning over 200 years, Chubb has consistently demonstrated a keen understanding of the complexities at play in the North American insurance market. As the second-largest insurance company in North America, Chubb’s recent consolidation of its two divisions – Chubb Specialty and Chubb Property & Casualty – marks a significant milestone in its ongoing quest for stability and growth. What are the implications of this strategic move, and how will it shape the future of the insurance industry in this region? Dive into our exclusive analysis to find out.

P&C Operations

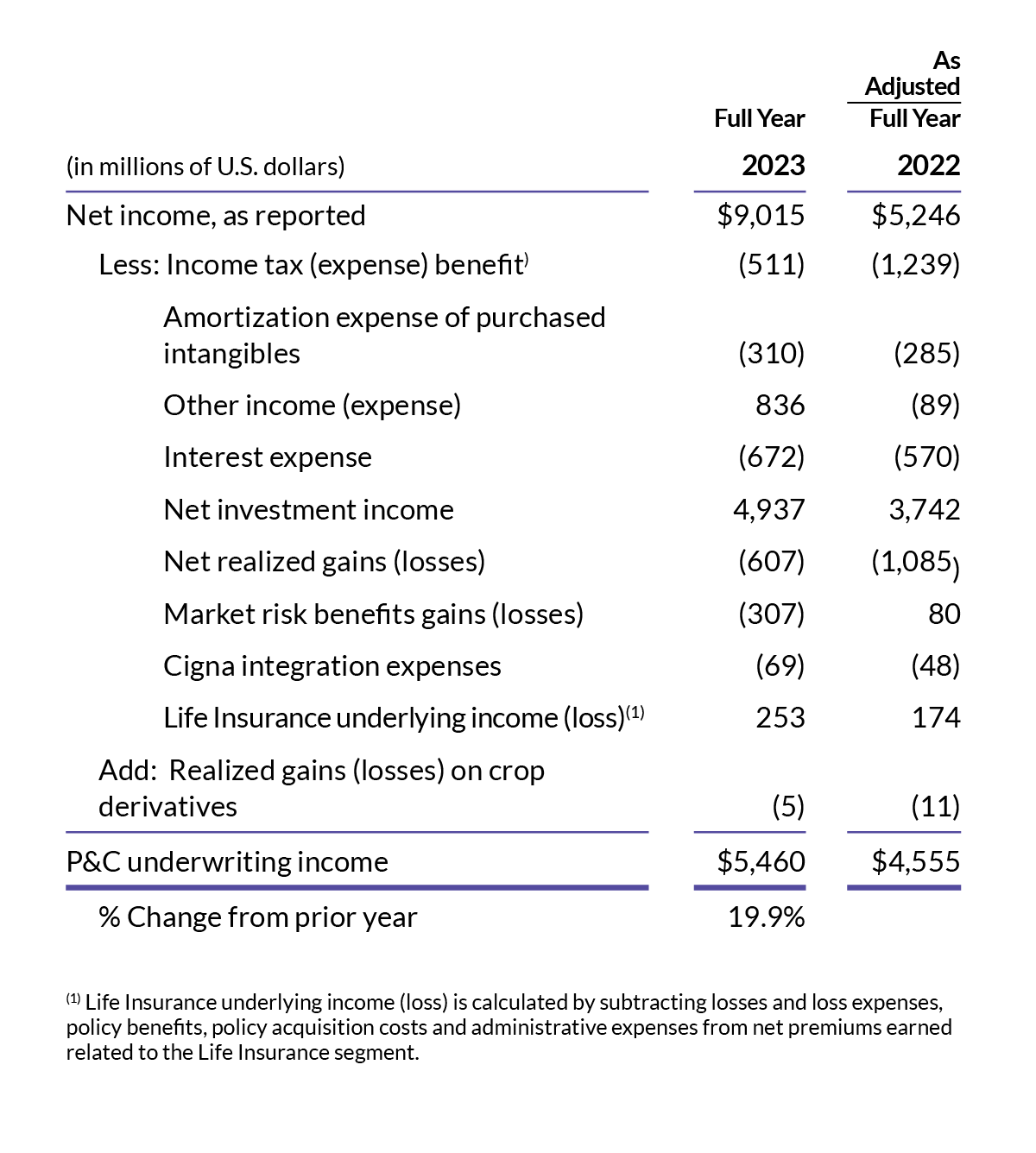

Chubb’s P&C combined ratio stood at 86.8%, a slight increase from the previous year. However, the company’s P&C underwriting income reached $1.42 billion, with a record low combined ratio of 83.2% excluding catastrophe losses. This impressive performance is attributed to Chubb’s strong underwriting discipline and effective risk management strategies.

For the six months, P&C underwriting income was $2.82 billion, up 6.8%, and was $3.43 billion, up 10.7%, on a current accident year excluding catastrophe losses basis. Both were records, demonstrating Chubb’s ability to consistently deliver superior underwriting results.

Life Insurance Segment

Life Insurance net premiums written grew by 24.5%, driven by strong performances in North America and Overseas General. Segment income also saw an 8.7% increase, reaching $276 million. This growth is a testament to Chubb’s diversified life insurance portfolio and its ability to capitalize on emerging opportunities.

Life Insurance net premiums written and deposits collected were $2.13 billion, up 27.4%, or 31.1% in constant dollars. This significant growth underscores Chubb’s commitment to expanding its life insurance business and delivering value to its customers.

Investment Income

Pre-tax net investment income rose by 28.2%, reaching $1.47 billion. Adjusted net investment income also saw a significant increase, reaching $1.56 billion. Both were records, highlighting Chubb’s expertise in managing its investment portfolio and generating strong returns.

Chubb’s investment strategy focuses on fixed-income investments, which enabled the company to capitalize on higher rates and widening spreads. This approach has allowed Chubb to maintain an average “A” rating and deliver impressive investment income growth.

Strategic Consolidation and Future Outlook

Consolidation of Divisions

Chubb’s consolidation of two divisions in North America is expected to improve operational efficiency and enhance its competitive profile. This move will allow the company to focus on high-growth areas and optimize its resources.

By streamlining its operations, Chubb aims to reduce costs and enhance its ability to respond to changing market conditions. This strategic consolidation is expected to drive long-term growth and profitability for the company.

Long-Term Strategies

Chubb’s acquisition of a majority stake in Huatai Group in China is expected to contribute meaningfully to revenue and earnings growth in both life and non-life operations. This strategic investment demonstrates Chubb’s commitment to expanding its presence in key markets and driving long-term growth.

The Huatai Group acquisition is a significant milestone in Chubb’s growth strategy, enabling the company to tap into the vast potential of the Chinese market. This move is expected to drive significant revenue and earnings growth for Chubb in the coming years.

Future Growth Prospects

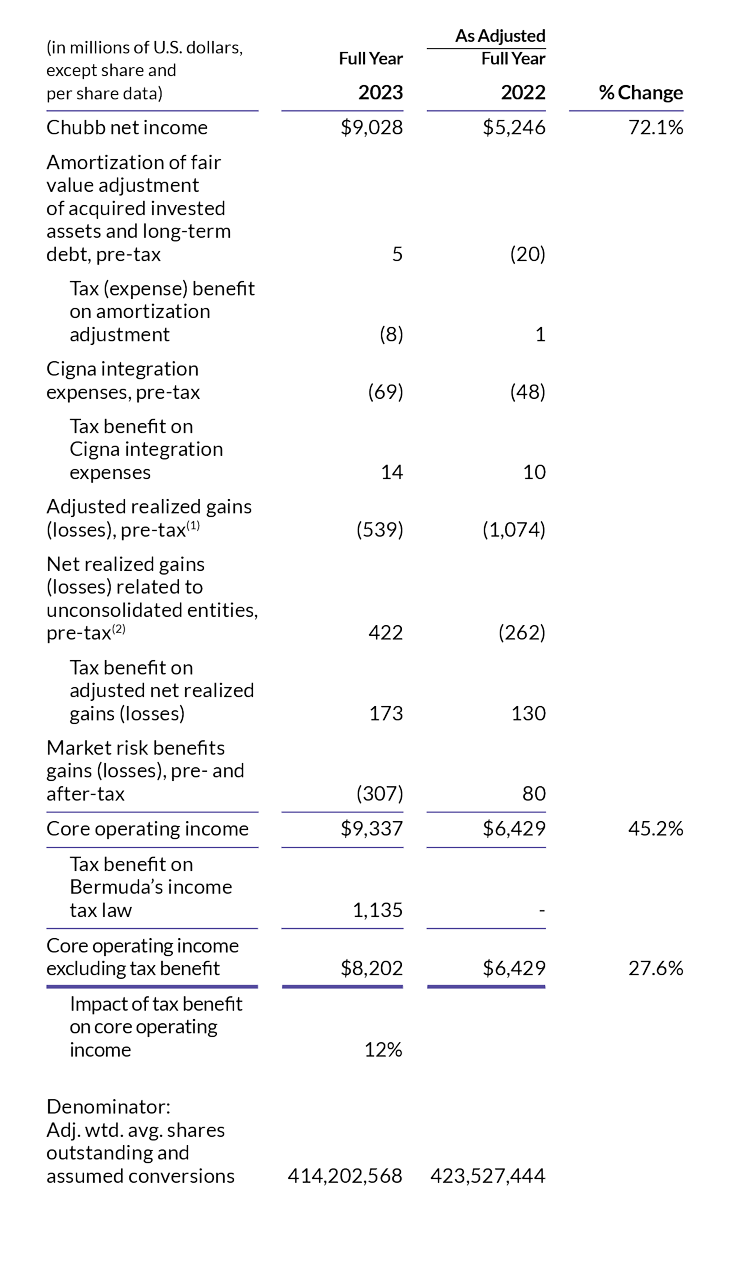

Chubb remains confident in its ability to continue delivering superior growth in operating earnings and earnings per share through a combination of P&C revenue and underwriting income, investment income, and life income.

The company’s diversified business portfolio, strong underwriting discipline, and effective investment strategies position it for continued growth and success in the long term. As Chubb continues to execute its growth strategies, it is well-positioned to maintain its industry-leading performance.

Conclusion

In conclusion, Chubb’s strategic decision to consolidate its North America Commercial and Personal Risk Services divisions has significant implications for the insurance industry. As discussed in this article, the move aims to streamline operations, enhance customer experiences, and drive business growth. By combining the expertise and resources of both divisions, Chubb is poised to offer more comprehensive and innovative risk management solutions to its clients.

The consolidation of these divisions not only underscores Chubb’s commitment to adapting to the evolving insurance landscape but also reflects the company’s forward-thinking approach to addressing the increasingly complex needs of its customers. As the insurance industry continues to navigate the challenges of technological disruption, changing regulatory requirements, and shifting customer expectations, companies like Chubb must be willing to innovate and transform to remain competitive. By consolidating its divisions, Chubb is positioning itself for long-term success and cementing its status as a leader in the North American insurance market.

As the insurance industry continues to evolve, one thing is clear: those who fail to adapt and innovate will be left behind. Chubb’s bold move to consolidate its divisions serves as a reminder that, in today’s fast-paced business environment, companies must be willing to disrupt themselves in order to stay ahead of the curve. As we look to the future, one question remains: which other insurance giants will follow suit, and how will this consolidation trend shape the industry’s landscape? Only time will tell, but one thing is certain – the insurance industry will never be the same again.

Add Comment