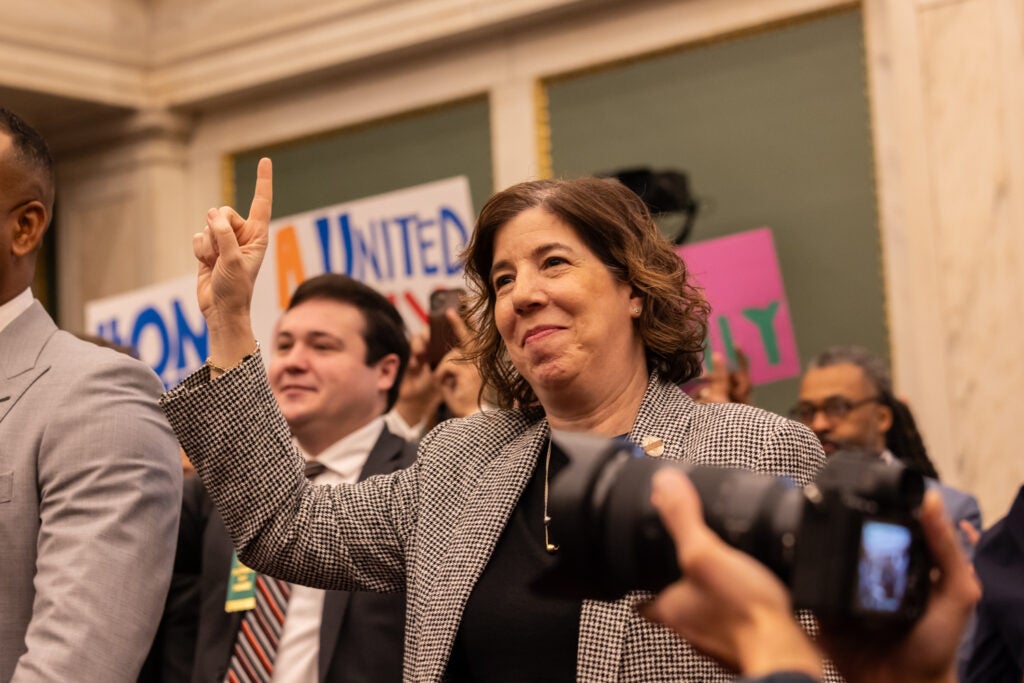

Breaking News in Philadelphia: Mayor Cherelle Parker Aims to Revamp City’s Tax Landscape In a bid to revitalize the economy and make the City of Brotherly Love a more attractive destination for entrepreneurs and residents alike, Philadelphia Mayor Cherelle Parker has set her sights on a bold new initiative: reducing both the business and city wage taxes. This move, as reported by WHYY, could have far-reaching implications for the city’s financial landscape and the lives of its citizens. With the goal of making Philadelphia more competitive with neighboring cities and boosting economic growth, Mayor Parker’s proposal is generating widespread buzz and sparking intense debate among local stakeholders. In this article, we’ll dive into the details of her plan, exploring what it could mean for Philly’s future and whether it’s the right prescription for the city’s fiscal woes.

Fiscal Responsibility and Budgeting

Mayor Parker’s approach to budgeting and financial management is centered around achieving fiscal responsibility and sustainability. Her administration has made significant contributions to the Budget Stabilization Reserve fund, demonstrating a commitment to responsible financial management.

One of the key strategies for managing debt and achieving financial sustainability is through the pension fund. The city’s pension fund has reached a 62% funding level, the highest in decades, and is expected to hit 80% by FY29 and 100% by FY33.

This achievement is a result of prudent financial planning and management, and it is expected to free up over a half billion dollars annually for future budgets. The city’s debt service is also expected to decrease by $200 million in FY30.

However, there are some positive but lean projected fund balances in the out-years of the plan. These include lower growth than projected for Wage and Real Estate Transfer taxes, a drop of about $300 million, and the spending of remaining American Rescue Plan Act (ARPA) stimulus funds this year.

The city’s pension fund is a significant component of its overall financial health, and the mayor’s administration has taken steps to ensure its stability. In the 1990s, the city borrowed $1.3 billion to shore up its pension fund, and it is still paying for it today. From now through FY29, the city will pay $1 billion in debt service, including an $80 million balloon payment due in ’29.

Given the significance of these financial challenges, the mayor has emphasized her administration’s commitment to fiscal responsibility. She has stated that her administration will be a responsible steward of the city’s finances and will take a holistic approach to managing its debt and achieving financial sustainability.

This approach is reflected in the mayor’s budget, which has no new taxes and invests $2 billion over five years in new operating and capital dollars. The budget focuses on five pillars: Public Safety, Clean and Green, Education, Economic Opportunity, and Quality of Life.

The budget is designed to address the city’s pressing needs while also promoting fiscal responsibility and sustainability. By prioritizing these areas, the mayor’s administration aims to create a more stable and prosperous future for the city’s residents.

Impact on the city’s credit rating and financial reputation

The mayor’s commitment to fiscal responsibility and sustainability is expected to have a positive impact on the city’s credit rating and financial reputation. By demonstrating responsible financial management and a commitment to achieving financial sustainability, the city is likely to attract more investors and businesses, which can help drive economic growth and development.

The city’s financial health is also likely to be viewed more favorably by rating agencies, which can result in a lower cost of borrowing and improved access to capital. This, in turn, can help the city achieve its goals and priorities while also promoting fiscal responsibility and sustainability.

Overall, the mayor’s approach to budgeting and financial management is centered around achieving fiscal responsibility and sustainability. By prioritizing these areas and taking a holistic approach to managing debt and achieving financial sustainability, the city is likely to experience significant benefits in terms of its credit rating, financial reputation, and overall economic health.

Pilot Programs and Innovative Initiatives

The mayor’s budget includes a number of innovative initiatives and pilot programs aimed at addressing the city’s pressing needs and promoting economic growth and development.

One of the key initiatives is the expansion of full-day schools, which aims to provide more opportunities for students and support families. The city is also investing in twice-weekly trash collection in some areas, which aims to improve the quality of life for residents.

Another initiative is the home ownership program, which aims to make it easier for residents to purchase homes and build wealth. The program includes a range of support services, including financial counseling and down payment assistance.

The mayor’s budget also includes a number of initiatives aimed at promoting economic growth and development. These include investments in workforce development and upskilling programs, which aim to prepare residents for the changing job market and promote economic mobility.

The city is also investing in business development programs, including the PHL Taking Care of Business (PHL TCB) neighborhood cleaning program. This program aims to improve the quality of life for residents by cleaning and maintaining public spaces.

By investing in these initiatives and pilot programs, the mayor’s administration aims to create a more prosperous and sustainable future for the city’s residents.

Full-day schools and education initiatives

The expansion of full-day schools is a key component of the mayor’s education agenda. This initiative aims to provide more opportunities for students and support families by offering a range of programs and services.

The city is investing in a range of education initiatives, including early childhood education programs, after-school programs, and vocational training programs. These initiatives aim to support students at all levels and provide them with the skills and knowledge they need to succeed.

The city is also investing in education infrastructure, including the renovation and construction of new schools. This investment aims to provide students with safe and modern learning environments that support their academic success.

Overall, the mayor’s education initiatives aim to create a more equitable and effective education system that supports students and promotes academic achievement.

Implications and Analysis

The mayor’s budget and initiatives have significant implications for the city’s economy and residents. By investing in key areas such as public safety, education, and economic opportunity, the mayor’s administration aims to create a more prosperous and sustainable future for the city’s residents.

One of the key implications of the mayor’s budget is its potential impact on city revenue. The budget includes no new taxes, and the city is relying on existing revenue streams to fund its initiatives and programs.

This approach has both benefits and drawbacks. On the one hand, it avoids the potential negative impacts of new taxes on businesses and residents. On the other hand, it may limit the city’s ability to raise revenue and fund its initiatives and programs.

The city’s revenue streams are also expected to be impacted by the decline in Wage and Real Estate Transfer taxes. This decline is expected to result in a drop of about $300 million in revenue, which will need to be addressed through other means.

Overall, the mayor’s budget and initiatives have significant implications for the city’s economy and residents. By investing in key areas and promoting fiscal responsibility and sustainability, the city is likely to experience significant benefits in terms of its economic health and quality of life.

Tax reform and its potential impact on city revenue

The mayor’s budget includes no new taxes, and the city is relying on existing revenue streams to fund its initiatives and programs. This approach has both benefits and drawbacks, as discussed above.

One of the key implications of the mayor’s approach is its potential impact on city revenue. The city’s revenue streams are expected to be impacted by the decline in Wage and Real Estate Transfer taxes, which is expected to result in a drop of about $300 million in revenue.

This decline in revenue is likely to be addressed through other means, such as reducing costs or increasing efficiency. However, it may also limit the city’s ability to raise revenue and fund its initiatives and programs.

Overall, the mayor’s approach to tax reform has significant implications for the city’s economy and residents. By investing in key areas and promoting fiscal responsibility and sustainability, the city is likely to experience significant benefits in terms of its economic health and quality of life.

The Role of Private Sector Partnerships

The mayor’s budget includes a number of initiatives aimed at promoting public-private partnerships and collaboration. These initiatives aim to leverage private sector resources and expertise to support the city’s goals and priorities.

One of the key initiatives is the home ownership program, which includes a range of support services, including financial counseling and down payment assistance. The city is partnering with private sector organizations to provide these services and support families in achieving their goal of homeownership.

Another initiative is the PHL Taking Care of Business (PHL TCB) neighborhood cleaning program. This program aims to improve the quality of life for residents by cleaning and maintaining public spaces. The city is partnering with private sector organizations to fund and implement this program.

The mayor’s budget also includes a number of initiatives aimed at promoting workforce development and upskilling programs. These initiatives aim to prepare residents for the changing job market and promote economic mobility. The city is partnering with private sector organizations to provide these programs and support residents in achieving their career goals.

Overall, the mayor’s approach to public-private partnerships has significant implications for the city’s economy and residents. By leveraging private sector resources and expertise, the city is likely to experience significant benefits in terms of its economic health and quality of life.

Strategies for leveraging private sector resources and expertise

The mayor’s budget includes a number of strategies for leveraging private sector resources and expertise. These strategies include:

- Partnerships with private sector organizations to fund and implement initiatives and programs;

- Collaboration with private sector organizations to provide support services and expertise;

- Use of private sector resources and expertise to develop and implement new initiatives and programs;

- Development of public-private partnerships to support the city’s goals and priorities.

These strategies aim to leverage the strengths of the private sector, while also promoting fiscal responsibility and sustainability. By working together with private sector organizations, the city is likely to experience significant benefits in terms of its economic health and quality of life.

- Use of private sector resources and expertise to develop and implement new initiatives and programs;

- Collaboration with private sector organizations to provide support services and expertise;

Challenges and Controversies

The mayor’s budget and initiatives have faced significant challenges and controversies. One of the key challenges is the potential impact of the budget on city revenue.

Another challenge is the potential impact of the budget on city services and infrastructure. The budget includes a number of initiatives aimed at reducing costs and increasing efficiency, but these may also limit the city’s ability to fund its services and infrastructure.

There are also controversies surrounding the budget and its priorities. Some critics argue that the budget does not do enough to address the city’s pressing needs, such as public safety and education.

Overall, the mayor’s budget and initiatives have significant challenges and controversies. However, by working together with stakeholders and promoting fiscal responsibility and sustainability, the city is likely to experience significant benefits in terms of its economic health and quality of life.

Critics of Mayor Parker’s tax reform proposal and budget

There are a number of critics of Mayor Parker’s tax reform proposal and budget. These critics argue that the budget does not do enough to address the city’s pressing needs, such as public safety and education.

They also argue that the budget’s reliance on existing revenue streams may limit the city’s ability to raise revenue and fund its initiatives and programs. Additionally, they argue that the budget’s focus on reducing costs and increasing efficiency may come at the expense of city services and infrastructure.

Overall, the critics of Mayor Parker’s tax reform proposal and budget argue that the budget does not provide a clear vision for the city’s future and may not be sufficient to address the city’s pressing needs.

Conclusion

Conclusion: Philly’s Mayor Cherelle Parker Unveils Tax Cuts for Business and City Workers

In a surprising move, Philadelphia Mayor Cherelle Parker announced plans to cut business and city wage taxes, sparking widespread debate and scrutiny. The city aims to balance fiscal sustainability with economic growth, and the proposed tax reforms have significant implications for local businesses and residents. According to sources, the tax cuts will target corporations and wealthy individuals, while the city will focus on small businesses and low-wage earners.

The decision has sparked concerns about the impact on city infrastructure, education, and social services. As the city grapples with rising costs and decreasing revenue, this move may exacerbate existing budget constraints. Many argue that reducing taxes will lead to increased poverty and inequality, particularly in marginalized communities. On the other hand, proponents of the plan contend that it will stimulate economic growth, attract new businesses, and improve the overall quality of life for city residents. As the mayor sheds light on her reasoning behind this bold move, it’s clear that the future of Philadelphia hangs in the balance.

Parker’s proposed tax cuts have far-reaching consequences, echoing concerns about urbanization, economic inequality, and the role of government in the modern economy. As we navigate the complexities of urban development, it’s essential to consider the long-term implications of policies like these. Will this move spark a revolution in city governance, or will it be met with resistance? One thing is certain – the impact of Mayor Parker’s tax reforms will be felt for years to come. As the city embarks on this uncharted terrain, it’s clear that the future is uncertain, but one thing is clear: the next chapter in Philadelphia’s story is about to unfold.

Add Comment