## Hold onto your student loan statements, folks! 🤯

The latest move from the Trump administration just dropped, and it’s shaking up the world of student debt like an earthquake in a library. Forget spreadsheets and calculators, this is a seismic shift in the way millions of Americans manage their loans. We’re talking about a change so big, so unexpected, it’s got everyone from Wall Street to your college roommate buzzing with speculation.

The Constitutional and Practical Challenges of Such a Move

The potential dismantling of the Department of Education (ED) under President Trump’s executive order raises significant constitutional and practical challenges. The Constitution grants Congress the power to establish and dissolve federal agencies, not the President. Therefore, any move to abolish the ED would require congressional approval, which is unlikely given the current political climate. Moreover, the ED oversees critical functions such as the administration of federal student loans, a portfolio valued at nearly $2 trillion. The complexity and scale of this operation make the transfer of these responsibilities to another federal agency, such as the Treasury, Commerce, or Small Business Administration (SBA), a daunting task.

Experts from the National Association of Student Financial Aid Administrators (NASFAA) and the Cato Institute have expressed concerns over the potential for increased errors and delays in loan processing. The intricate nature of student loan management, including income-driven repayment plans and loan forgiveness programs, would make a smooth transition highly challenging. The administrative burden and risk of disrupting the loan system could lead to significant financial and procedural complications for millions of borrowers.

Job Cuts and Their Consequences

The Department of Education’s Job Cuts and Their Impact

The Department of Education’s (ED) plan to lay off nearly half its workforce poses substantial risks to the efficient management of student loans. Approximately 10% of the Federal Student Aid (FSA) office’s staff has already accepted buyout offers, and the recent layoffs could exacerbate the strain on the remaining workforce. As such, the ED is facing a significant reduction in capacity, which could hinder its ability to process loan applications and manage the student loan portfolio effectively.

The Risk of Increased Defaults and Unprocessed Applications

The impending layoffs and restructuring could result in a backlog of loan applications and an increased likelihood of processing errors. These inefficiencies could lead to delays in loan disbursements and a heightened risk of defaults. The Education Department’s capacity to monitor loan performance and provide necessary support to borrowers is crucial for maintaining the stability of the student loan system. A reduced staff could undermine this support, potentially causing financial strain on borrowers and increasing the risk of defaults.

The Human Factor

The Effect on Employees and Borrowers

The massive layoffs within the Department of Education (ED) are not only impacting the agency’s operational capacity but also significantly affecting its employees. Many experienced and dedicated staff members are leaving or have left, leading to a loss of institutional knowledge and expertise. This brain drain could disrupt the seamless functioning of the ED, especially in critical areas such as loan processing and customer service.

For borrowers, the human impact is equally concerning. The ED’s staff reductions could result in longer wait times for assistance, more errors in loan processing, and a general decline in the quality of service. Borrowers may face delays in loan disbursements, issues with repayment plans, and difficulties in obtaining timely support, all of which could exacerbate the already complex challenges of managing student debt.

The Potential for a More Error-Prone System

With the departure of experienced staff and the reduction in workforce, the ED’s ability to maintain a high level of accuracy and efficiency in loan management is at risk. The complex nature of student loans, including income-driven repayment plans and loan forgiveness programs, requires meticulous handling. The reduced staff could lead to a rise in processing errors, delayed loan applications, and a more error-prone system overall. Borrowers might experience incorrect loan payments, misdirected funds, and other administrative oversights, further complicating their already challenging financial situations.

Public Service Loan Forgiveness: A Targeted Overhaul

The Current State

The Public Service Loan Forgiveness (PSLF) program is a critical component of the student loan landscape, offering relief to public servants who commit to ten years of qualifying employment and loan payments. This program has been a lifeline for many borrowers, particularly those in public sector jobs such as teachers, nurses, and government workers. Under current law, the PSLF program is administered by the Department of Education (ED) and is designed to incentivize individuals to pursue careers in public service despite the financial burdens of student debt.

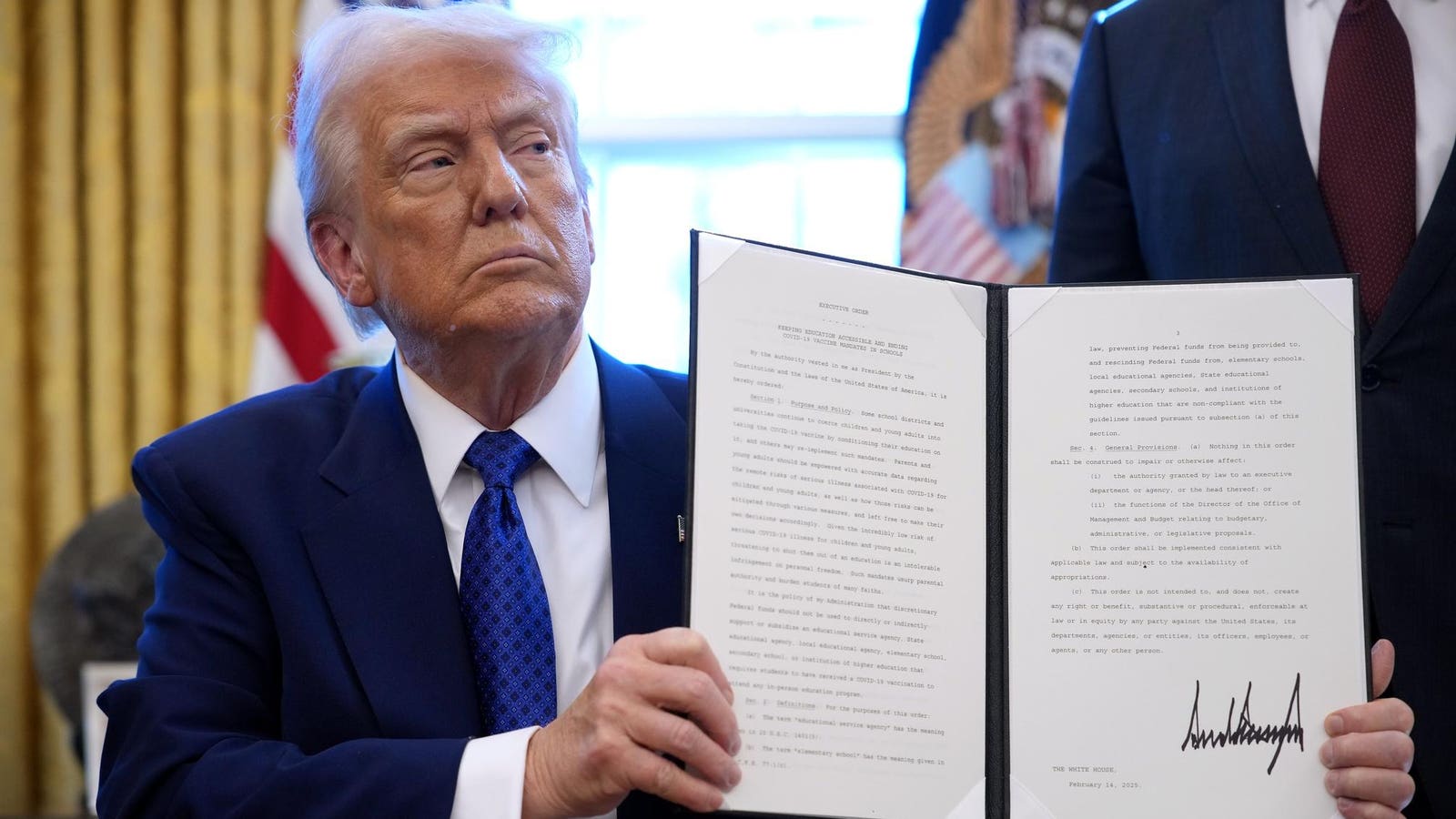

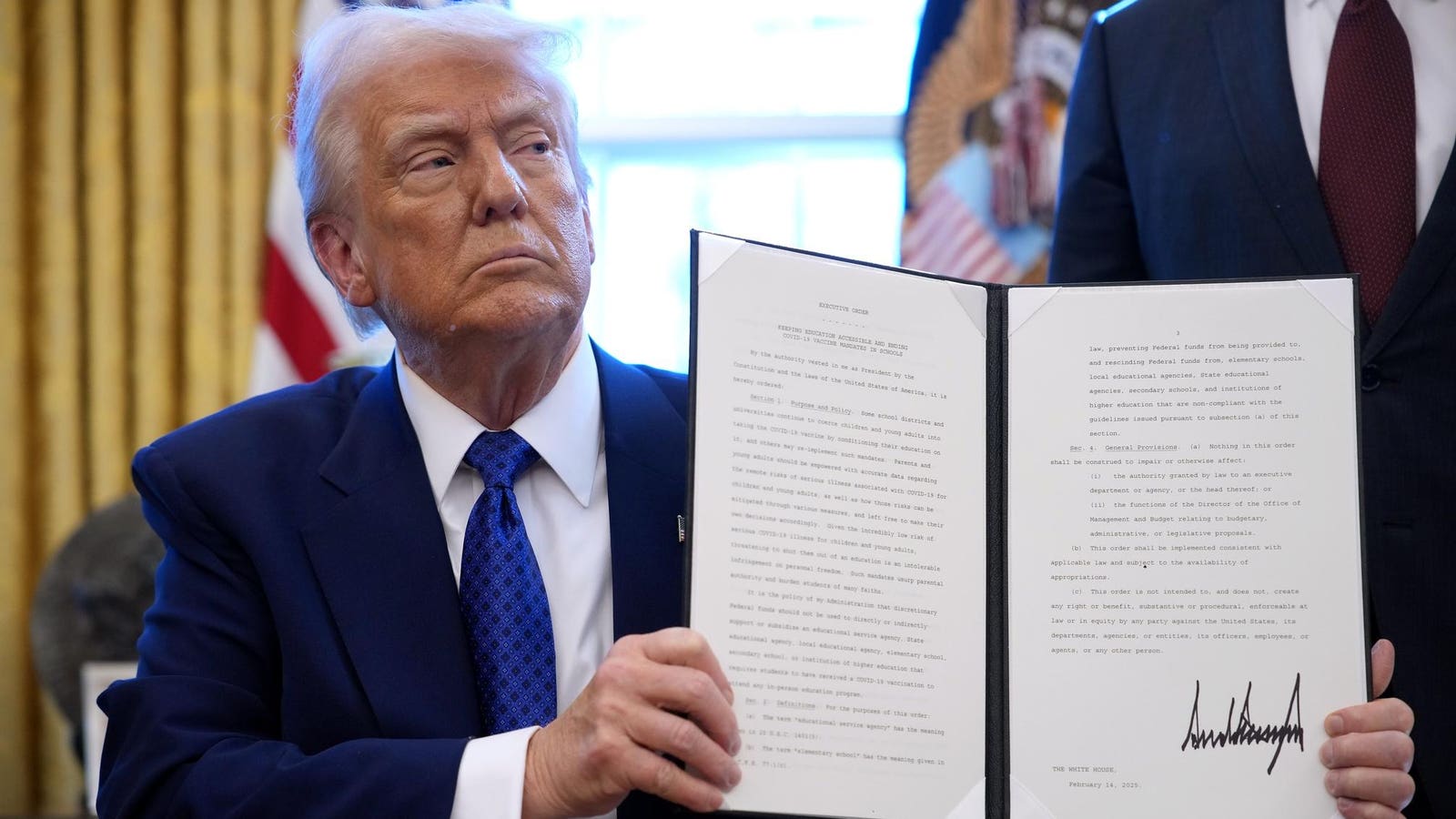

Trump’s Executive Order on the Program

President Trump has signed an executive order aimed at revising the Public Service Loan Forgiveness (PSLF) program. The order seeks to limit eligibility for PSLF by excluding those who work for organizations that oppose his policies, such as those advocating for transgender rights or undocumented immigrants. This executive action, however, is limited in scope and requires Congressional approval. Without legislative approval, the changes proposed by Trump cannot be implemented, leaving the existing PSLF program largely intact, at least in the near term.

The Need for Congressional Approval

Trump’s executive order on the PSLF program faces constitutional and procedural hurdles, necessitating Congressional approval to effectuate any significant changes. The legislative process is complex and time-consuming, involving committee hearings, floor debates, and votes that could take months or even years. The likelihood of bipartisan support for Trump’s proposed changes is low, given the current political dynamics in Congress. This means that any overhaul of the PSLF program is unlikely to proceed without significant legislative barriers being addressed.

The Impact on Public Servants

The proposed changes to the Public Service Loan Forgiveness (PSLF) program could have far-reaching implications for public servants. If implemented, public servants working for organizations deemed politically unaligned with the Trump administration’s policies could lose eligibility for loan forgiveness. This could dissuade individuals from choosing public service careers, impacting sectors that rely on public servants such as education, healthcare, and government. The uncertainty surrounding the future of PSLF may lead to confusion among current and future borrowers, potentially causing delays in achieving loan forgiveness.

The Save Act and Other Repayment Plans

The Biden-Era Plan

The Saving on a Valued Education (SAVE) Act, introduced during the Biden administration, aimed to provide lower monthly payments for borrowers based on their income. However, the SAVE Act has been blocked in federal court, and the Trump administration is unlikely to revive it. This leaves borrowers in a precarious position, as the potential benefits of the SAVE Act are now in jeopardy. The current lack of support for the SAVE Act means that borrowers will not see the immediate relief that the act was designed to provide.

The Status Post-Trump’s Executive Order

Following Trump’s executive order, the future of the SAVE Act remains uncertain. The Trump administration’s decision to block the SAVE Act could have long-term effects on borrowers, particularly those who were counting on its benefits. The Treasury Department’s decision to pause applications for income-driven repayment plans for at least three months further complicates the situation. This pause, coupled with the suspension of the SAVE Act, could leave many borrowers without access to more affordable repayment options, potentially leading to increased financial stress and higher default rates.

Income-Driven Repayment Plans

Trump’s administration has paused applications for income-driven repayment plans for at least three months, citing potential unlawfulness in the current structure of these plans. The administration has suggested that any future repayment plans may be more costly for borrowers. This pause could result in a higher financial burden on borrowers, as they may not have access to the lower monthly payments that income-driven plans typically offer. The shift towards more costly repayment plans could disproportionately affect low-income borrowers, who often rely on these programs to manage their student debt effectively.

The Legal and Political Landscape

Can President Trump Disband the Department of Education?

The idea of dismantling the Department of Education (ED) presents significant legal and political obstacles. The Constitution explicitly grants Congress the power to establish and abolish federal agencies. Therefore, President Trump’s executive order, while symbolic, cannot unilaterally dissolve the ED. The ED oversees vital functions such as the administration of federal student loans and the enforcement of civil rights laws in education. Transferring these responsibilities to other agencies, like the Treasury Department or the SBA, would require legislative action and would face significant technical and logistical challenges.

The Need for Congressional Approval

For the Department of Education to be disbanded or its functions transferred, Congress must pass specific legislation. This requires a 60-vote supermajority in the Senate to overcome a filibuster. Given the current political climate, achieving this supermajority is highly improbable, as it would necessitate bipartisan support. The complexity of the transfer, coupled with the deep-rooted functions of the ED, makes the legislative process challenging and time-consuming.

The Political Will and Feasibility

The political will for such a significant shift in federal education policy is lacking. Even if the Trump administration pushes for the transfer of the Federal Student Aid office to the Treasury or another agency, bipartisan support for such a move is unlikely. The technical challenges of transferring the massive student loan portfolio, which includes managing nearly $2 trillion in loans, are substantial. The complexity of handling income-driven repayment plans, loan forgiveness programs, and other student aid initiatives would require extensive coordination and significant resources, which may not be readily available.

Conclusion

Shocking: Trump Orders Shift on Student Loan Management

Following weeks of intense debate and scrutiny, President Donald Trump has finally unveiled a new plan aimed at reforming the student loan system. As the country continues to grapple with the twin crises of rising college costs and crippling debt, Trump’s move marks a significant shift in the conversation. The proposed plan, outlined in a recent official document, seeks to consolidate federal student loan programs, increase loan forgiveness, and reform the existing repayment system.

The implications of Trump’s plan are far-reaching and multifaceted. By consolidating federal student loan programs, the federal government aims to reduce bureaucratic overhead and streamline the application process. This, in turn, could lead to faster and more efficient loan disbursement, potentially reducing loan default rates. Furthermore, the plan’s emphasis on increasing loan forgiveness and reforming the repayment system could help alleviate the burden of student loan debt on American citizens, particularly those from low-income backgrounds. However, critics argue that the plan’s restrictive language and narrow focus on forgiveness could actually exacerbate the problem, particularly for borrowers with high levels of debt.

As the student loan landscape continues to evolve, it is clear that Trump’s plan represents a significant turning point in the national conversation about student loan reform. While the details of the plan are still evolving, one thing is clear: this is a moment that will have far-reaching consequences for millions of Americans. As the future of student loan policy hangs in the balance, one thing is certain: the next few years will be marked by unprecedented pressure to address this critical issue. Will the proposed plan be a beacon of hope for those struggling with student loan debt, or will it serve as a reminder of the entrenched interests that have long shaped the nation’s student loan system? The answer, much like the fate of student loan debt itself, remains uncertain – but one thing is clear: the future of student loan policy is in the hands of a nation staring at its own financial crisis.

Add Comment