## Lights, Camera, Corporate Clashes! Disney vs. Comcast: Who Wins the Fox Family Feud? Hold onto your Mickey ears, folks, because Hollywood’s about to get a whole lot messier. Disney and Comcast, two titans of the entertainment industry, are locked in a high-stakes battle for control of 21st Century Fox. It’s a slugfest for the ages, with billions of dollars and the future of iconic franchises hanging in the balance. We’re diving deep into the trenches of this corporate clash, dissecting the motives, the strategies, and the potential consequences for both giants, and ultimately, for you, the consumer. Buckle up, this is going to be a wild ride.

Battle Brewing between Disney, Comcast – Fox Business

Impact on Traditional TV and Cable

The ongoing battle for control over the future of entertainment, especially in the realm of traditional TV and cable, is heating up as Disney and Comcast vie for the crown. The acquisition of 21st Century Fox’s assets by Disney, pending regulatory approval, is poised to shake the foundations of the traditional TV model. Gizmoposts24’s analysis reveals that this shift could be a pivotal moment for the industry, signaling the decline of traditional pay-TV models and the rise of direct-to-consumer (D2C) offerings.

The implications of this merger are severe for traditional TV providers. According to eMarketer, the number of U.S. households with pay-TV subscriptions is expected to decline by 4.2% to 86.5 million this year, and by 2023, it could plummet to 72.7 million from 100.5 million in 2014. Comcast, one of the major players in this space, is not standing idly by, as it plans to launch its own D2C streaming service, HBO Max, aimed at capturing the rapidly growing cord-cutting audience.

Comcast’s D2C Strategy

Current Offerings and Future Plans

Comcast, with its reach and resources, is well-positioned to compete in the D2C domain. HBO Max is set to launch with a mammoth library of content, including classic and new HBO series, Warner Bros. films, DC Comics, and more. Comcast aims to leverage its existing customers and infrastructure to expand its D2C offerings, positioning itself as a formidable competitor to the likes of Disney and Netflix.

Potential for Growth

The potential for growth in the D2C market is immense. With the anticipated launch of Disney Plus and HBO Max in the coming months, the competition will intensify, potentially driving innovation and expansion in content offerings. Comcast’s strategy includes not only launching HBO Max but also integrating it with existing services to provide a seamless experience for users, potentially bundling it with internet and other services to gain a competitive edge.

Industry Implications and Regulatory Challenges

Decline in Pay-TV Subscribers

According to eMarketer, the number of cord-cutters is expected to rise to 25% by 2022, highlighting the trend towards streaming services and away from traditional cable and satellite subscriptions. This shift is not just a passing fad; it’s a fundamental change in how consumers access and consume content, with significant financial implications for traditional TV providers.

Advertising and Viewership Shifts

With the decline in TV viewership across all age groups, traditional networks are facing increasing pressure to adjust their advertising strategies. Ad pricing and strategies must evolve to account for the loss of viewers, while the rise in D2C services means that traditional networks will need to adapt to remain competitive. Networks like Disney and NBCU are already responding by enhancing their digital offerings and integrating more exclusive content to retain and attract viewers.

Regulatory Hurdles and Approvals

Antitrust Concerns

Disney’s acquisition of Fox’s assets has sparked antitrust concerns, with regulators in the U.S. and abroad scrutinizing the deal to ensure it does not stifle competition. The acquisition is under close watch to guarantee that it does not create a monopoly in the entertainment industry. The deal has also faced challenges from Comcast, which attempted to outbid Disney for Fox’s assets, only to be outmaneuvered by Disney’s offer of $71.3 billion.

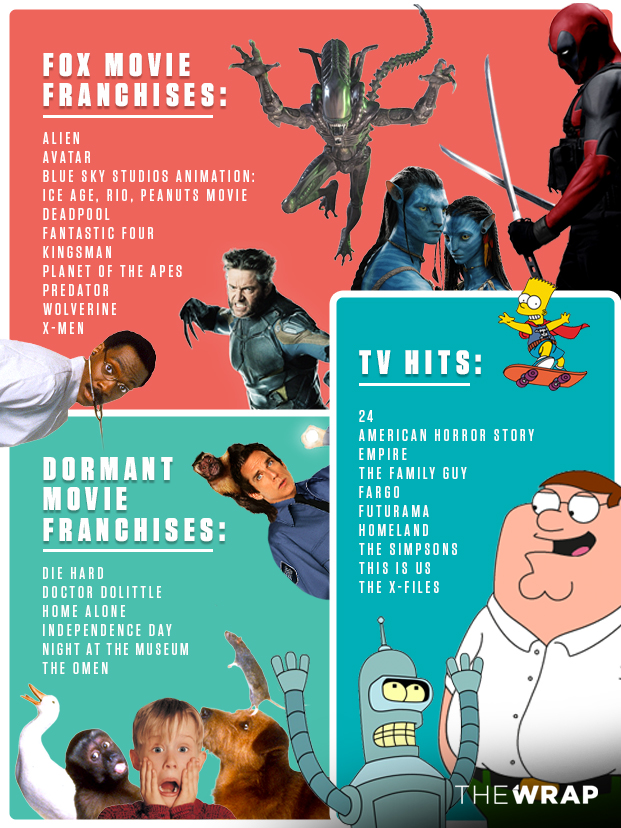

Integration and Layoffs

Upon completion of the Disney-Fox merger, the integration of assets is projected to result in significant job losses, with estimates ranging from 5,000 to 10,000 employees potentially affected. Integration challenges are expected, as Disney will need to seamlessly blend Fox’s extensive content library into its own robust portfolio.

The Future of Entertainment: What Consumers Can Expect

New Streaming Services and Content

Upcoming Services

The launch of Disney Plus and HBO Max is anticipated to redefine the streaming landscape. HBO Max, with its vast library and exclusive content, is set to challenge Netflix and other existing streaming services, while Disney Plus aims to become a one-stop shop for all things Disney, including beloved franchises like Marvel, Star Wars, and Pixar. Both services are expected to launch in 2020, marking the beginning of a significant shift in consumer behavior and content consumption.

Content Availability and Pricing

Consumers can expect a plethora of content options but at a price. The advent of these new services may push the boundaries of pricing, especially as Disney and HBO Max aim to capture a substantial market share. This could potentially drive the trend of cord-cutting even further, as consumers opt for more cost-effective and convenient streaming services.

The Role of Traditional Media in the Digital Age

Adaptation and Survival

Traditional media companies like Disney and Fox are adapting by embracing digital transformation. Disney, for instance, is leveraging its extensive IP and brand loyalty to launch Disney Plus, aiming to tap into the growing demand for streaming services. Traditional TV networks are pivoting towards exclusive content, with networks like HBO and Showtime already leading the way.

Consumer Behavior and Preferences

Consumer behavior is evolving, with a strong preference for on-demand content and personalized viewing experiences. The rise of streaming services caters to these preferences, offering flexibility and a host of content options. Traditional TV and streaming services are set to coexist, but the future may favor those that can adapt and innovate.

Conclusion

As the battle between Disney, Comcast, and Fox Business heats up, it’s clear that the stakes are high and the consequences are far-reaching. The recent acquisition by Comcast of 21st Century Fox’s assets for a whopping $70 billion sets off a domino effect, threatening the very fabric of the media landscape. Disney, having already acquired 20th Century Fox in 2019, is now facing a major competitor in Comcast, which has its own stake in the game. This power struggle has significant implications for consumers, advertisers, and the media industry as a whole.

The significance of this battle lies in its impact on the future of entertainment, sports, and news. With Comcast’s acquisition, the company gains access to a vast library of content, including popular franchises like Star Wars, The Simpsons, and NFL Sunday Night Football. This presents a formidable challenge to Disney, which must adapt and innovate to maintain its competitive edge. Moreover, the shift in control could also lead to changes in content creation, distribution, and monetization strategies, which in turn could affect the way we consume media. The very essence of the media industry is at stake, and the outcome will be watched with bated breath by industry insiders and consumers alike.

Add Comment