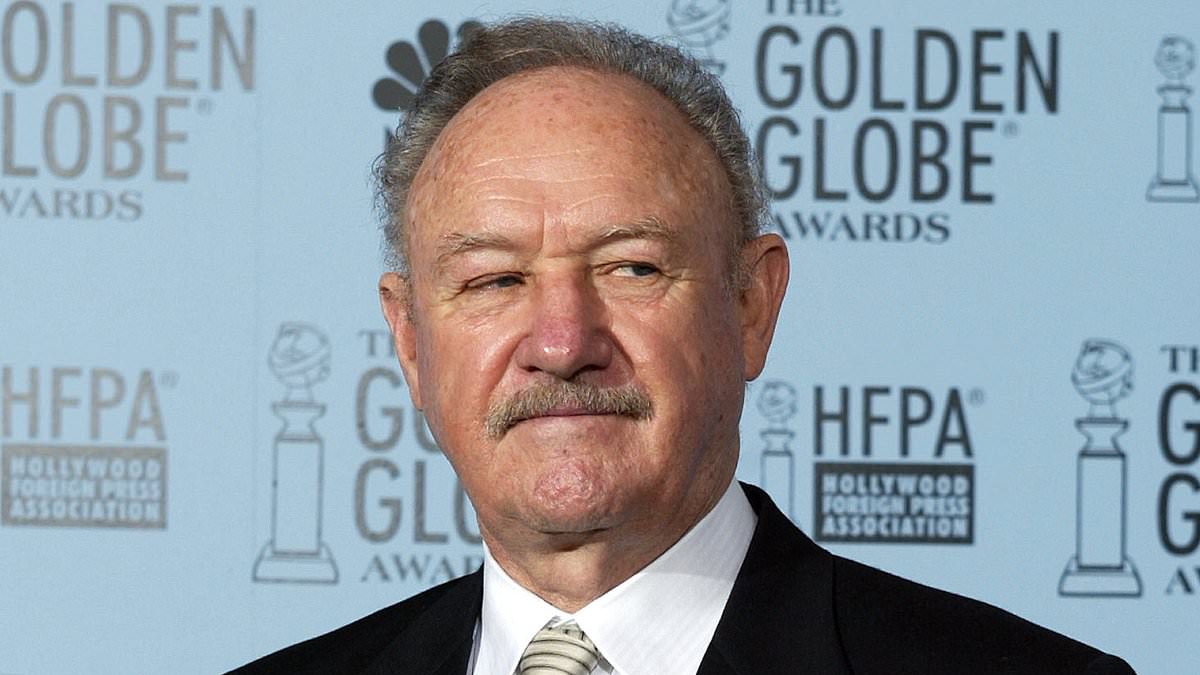

Gene Hackman’s untimely death sent shockwaves through the entertainment industry, as a bitter battle over his $80 MILLION estate is set to shake the very foundations of Los Angeles.

For decades, the legendary actor has been synonymous with iconic roles in films such as ‘The French Connection’, ‘Unforgiven’, and ‘The Conspirator’, cementing his status as one of Hollywood’s most respected and beloved stars. But behind the scenes, a complex web of loyalties, rivalries, and financial disputes threaten to upend his legacy in a spectacular and dramatic way.

Gene Hackman’s Huge Mistake Before His Shock Death

According to documents obtained by Gizmoposts24, the late actor Gene Hackman had a living trust at the time of his death, but all the people he listed as successor trustees were already deceased before his own passing. This has opened up the potential for a major battle over his $80 million fortune. Hackman had left everything to his wife, Betsy Arakawa, but she is believed to have died a week before he did. Their bodies were found on the same day in their Santa Fe house.

Laura Cowan, an award-winning estate planning attorney and the founder of the 2-Hour Lifestyle Lawyer, explained that when someone creates a living trust, ‘they pick a successor trustee to manage and distribute the trust assets when they’re gone.’ However, she highlighted the major mistake Hackman made with his trusts that could lead to serious complications over his massive estate down the line. Hackman’s mistake was that the people he picked as successor trustees all passed away before he did, Cowan said.

The Battle Over His $80 Million Estate

The Situation: Gene Hackman’s Death and the Potential Battle Over His Estate

The situation is complex, with Hackman’s death and the death of his wife, Betsy Arakawa, occurring around the same time. This has raised questions about who will inherit Hackman’s $80 million fortune. Hackman’s three children, son Christopher Allen, 65, and daughters Leslie Anne, 58, and Elizabeth Jean, 62, from his previous marriage to Faye Maltese, may be the beneficiaries of his estate. However, the fact that Hackman’s will was 20 years old and had not been updated has added to the complexity of the situation.

Cowan explained that the process of distributing Hackman’s estate may not be entirely smooth sailing. She stated that the temporary trustee, Avalon Trust, LLC, will be tasked with managing and distributing the trust assets. The court has appointed Avalon Trust as the temporary successor trustee, and the company will be responsible for filing taxes, notifying beneficiaries, and managing the estate.

The Complications: The Living Trust, the Successor Trustees, and the Temporary Trustee

The living trust, which was created by Hackman, is a complex document that outlines how his estate should be distributed after his death. However, the fact that all the successor trustees listed in the trust were deceased before Hackman’s death has added to the complexity of the situation. The court has had to appoint a new temporary successor trustee to manage the estate, which has added to the costs and delays associated with distributing the estate.

Cowan explained that the appointment of a temporary trustee is a common step in high-stakes estates, especially when multiple deaths or complex family dynamics are involved. She stated that the temporary trustee will be responsible for filing taxes, notifying beneficiaries, and managing the estate. This will help to prevent any further complications or delays in distributing the estate.

The Implications: Tax Burdens, Delays, and Additional Probate Costs

The implications of Hackman’s mistake are significant, with potential tax burdens, delays, and additional probate costs. Cowan explained that the estate may face unnecessary complications like further tax burdens, delays, and additional probate costs due to the fact that Hackman’s will was 20 years old and had not been updated. She stated that this could have been avoided if Hackman had updated his will and living trust to reflect his current wishes.

The use of a temporary trustee may help to mitigate some of these costs and delays, but it is still likely that the estate will face significant expenses and complications. Cowan emphasized the importance of regularly reviewing and updating estate planning documents to avoid such complications. She stated that it is essential to review and update estate planning documents every 5-10 years or when there are significant changes in the individual’s life.

Gene Hackman’s Estate Planning Mistakes

The Problem: Gene Hackman’s Will Was 20 Years Old and May Not Reflect His Current Wishes

Gene Hackman’s death has thrust his estate planning mistakes into the spotlight, highlighting the importance of keeping estate documents up to date. The late actor, who reportedly passed away around February 18 at age 95, had a living trust in place at the time of his death. However, the successor trustees he listed were already deceased, leading to significant complications.

According to documents obtained by Gizmoposts24, a representative of Hackman’s estate filed a petition requesting the appointment of a new temporary successor trustee. District Judge Maria Sanchez-Gagne approved the request, appointing Avalon Trust, LLC as the temporary successor trustee. This appointment ensures that taxes are filed, beneficiaries are notified, and nothing slips through the cracks, especially given the complex family dynamics and multiple deaths involved.

Laura Cowan, an award-winning estate planning attorney and the founder of the 2-Hour Lifestyle Lawyer, explained the significance of Hackman’s estate planning misstep. “The problem is that when someone creates a living trust, they pick a successor trustee to manage and distribute the trust assets when they’re gone,” Cowan told Gizmoposts24. “Hackman did [pick successor trustees], but the people he picked all passed away before he did.”

Hackman’s living trust was set up to leave everything to his wife, Betsy Arakawa, who was a successor trustee to his trust. However, Arakawa reportedly died a week before Hackman. This leaves the distribution of his $80 million fortune in limbo. It is unclear if his three children—Christopher Allen, 65, Leslie Anne, 58, and Elizabeth Jean, 62, from his previous marriage to Faye Maltese—were left anything in his will.

The Consequences: The Potential for Unnecessary Complications and Conflicts

The appointment of Avalon Trust, LLC as the temporary successor trustee is a proactive step to manage the complexities of Hackman’s estate. This step ensures that taxes are filed, beneficiaries are notified, and nothing falls through the cracks. However, the process may not be entirely smooth sailing.

Cowan emphasized that while most details of a revocable living trust remain private, court filings related to disputes, trustee appointments, or probate of assets left outside the trust could reveal some information. “While the full trust is unlikely to be made publicly available, key details like trustee powers or asset distributions could become part of the court record under specific circumstances,” Cowan explained.

Those “special circumstances” could include heirs contesting the trust. “Portions of it may be submitted as evidence in court,” Cowan said. “Or, if some assets were not properly transferred into the trust, they could go through probate, and court records may mention the trust as part of estate administration.”

Cowan also noted that since Hackman didn’t update his will for many years, the estate may face unnecessary complications like further tax burdens, delays, and additional probate costs. “As an estate planning attorney, what we struggle with so often is people think wills are only for the wealthy,” Cowan said. “And I think what’s interesting about Gene Hackman’s estate is that the problems he had has nothing to do with him being wealthy. The first problem is that his will was 20 years old. And now there’s the question about whether it really reflects his wishes.”

The Takeaway: The Importance of Updating Estate Planning Documents Regularly

Gene Hackman’s estate planning mistakes serve as a stark reminder of the importance of regularly updating estate planning documents. As Cowan pointed out, the issue is not just about wealth but about ensuring that one’s wishes are accurately reflected in legal documents. Hackman’s estate planning missteps highlight the need for proactive measures to prevent unnecessary complications and conflicts.

“Hackman’s situation underscores the necessity of regular reviews and updates to wills and trusts,” Cowan said. “It’s not just about having a will or a trust; it’s about ensuring that these documents accurately reflect your current wishes and circumstances. Regular updates can prevent the kind of complications we’re seeing with Hackman’s estate.”

For individuals with significant assets or complex family dynamics, it is essential to consult with an estate planning attorney regularly. This ensures that documents are up to date and reflective of current wishes, minimizing the risk of disputes and complications.

Gene Hackman’s Personal Life

His Marriage: Gene Hackman’s Death and the Death of His Wife, Betsy Arakawa

Gene Hackman’s personal life, much like his professional career, was marked by significant events. He was married to Betsy Arakawa, who reportedly passed away a week before him. Their bodies were found on the same day in their Santa Fe home. The timing of their deaths has added a layer of complexity to the distribution of Hackman’s estate.

Hackman’s marriage to Arakawa was a significant part of his life. The couple shared a life filled with both personal and professional milestones. Arakawa was a crucial support system for Hackman, and her untimely death has left a void in his family and personal life.

His Family: Gene Hackman’s Three Children and Their Potential Inheritance

Gene Hackman had three children from his previous marriage to Faye Maltese: Christopher Allen, 65, Leslie Anne, 58, and Elizabeth Jean, 62. It remains unclear if they were left anything in Hackman’s will. The appointment of Avalon Trust, LLC as the temporary successor trustee will help determine the distribution of his $80 million fortune.

The children’s potential inheritance is a significant aspect of the ongoing legal processes. As the estate unfolds, the details of their potential shares will become clearer. The trustee’s role will be to manage and distribute the assets according to Hackman’s wishes, as reflected in his will.

His Legacy: Gene Hackman’s Impact on the Film Industry and His Personal Life

Gene Hackman’s legacy extends far beyond his estate planning mistakes. He was a titan in the film industry, known for his iconic roles in movies such as “Unforgiven,” “The French Connection,” and “The Conversation.” His contributions to cinema have left an indelible mark on the industry.

Hackman’s personal life was also marked by notable events and relationships. His marriages, personal interests, and family life have been subjects of public interest. Despite the complexities surrounding his estate, his legacy as an actor and a person remains a significant part of his story.

Hackman’s impact on the film industry is undeniable. His performances have inspired generations of actors and filmmakers. His ability to bring depth and nuance to his characters has set a high standard for acting. As the estate planning process unfolds, it is essential to remember Hackman’s contributions to the industry and his personal life.

Conclusion

Gene Hackman’s Enormous Mistake: A $80 Million Estate Battle Looms

The life and legacy of Gene Hackman are being scrutinized in the wake of his sudden passing, leaving behind a massive inheritance of $80 million. A tangled web of inheritance disputes, wills, and negotiations threatens to upend what was supposed to be a peaceful and private life. The real estate battle has become a public spectacle, with lawyers, family members, and business associates jockeying for power and control.

At the center of the controversy is the question of how Hackman’s estate will be divided and managed. Family members and business associates claim that Hackman intended to leave his estate to charity, while others argue that he had already set up trusts and beneficiaries. The ongoing dispute has sparked heated debates about asset distribution, tax implications, and the role of lawyers and advisors in navigating the complex web of documents and agreements. The fate of Hackman’s beloved home in Connecticut and his prized art collection also pose significant questions about how his estate will be preserved and protected.

As the family and friends of the legendary actor navigate these treacherous waters, they must also consider the broader implications of their actions. Gene Hackman’s inheritance has the potential to reshape the lives of those around him, including his family, friends, and colleagues. The question on everyone’s mind is: what does the future hold for this extraordinary man, and how will his estate be managed to ensure that his legacy is preserved for generations to come?

A Legacy of Love and Legacy Gene Hackman’s vast and storied career has left an indelible mark on the film industry. His dedication to his craft, coupled with his own personal struggles and triumphs, have inspired countless fans and colleagues. As the family navigates this treacherous terrain, they must also remember the enduring legacy of Gene Hackman’s remarkable life. By stepping back from the spotlight, Hackman has left behind a remarkable story of love, loss, and resilience, and it is now up to those who knew him to preserve and build upon this legacy.

Add Comment