## Hold onto your hats, folks, because the future of tech is looking seriously green. Nvidia isn’t just another tech giant; they’re the engine driving the AI revolution, the brains behind your next-gen gaming experience, and the secret sauce powering the metaverse. The Motley Fool reckons there are 300 billion reasons why you should jump on the Nvidia train before they become the undisputed king of the hill. Intrigued? We were too. Buckle up as we delve into the mind-blowing potential of Nvidia and explore why this budding business is poised to become a tech titan.

A Stellar Growth Year: AMD’s Impressive Earnings

AMD’s earnings in Q3 2023 were nothing short of impressive, with a 42% year-over-year growth in revenue. This significant increase can be attributed to the improving PC market, which has had a profound impact on AMD’s earnings. According to Gartner, global PC shipments increased 0.3% in the fourth quarter of 2023, marking the first rise in over a year. This upward trend is expected to continue throughout 2024, further boosting AMD’s revenue.

In its client segment, revenue rose 42% year over year to $1.4 billion, demonstrating the company’s ability to capitalize on the improving PC market. This growth is a testament to AMD’s strong product lineup and its ability to meet the demands of a recovering PC market.

A No-Brainer Investment: Why AMD’s Stock is a Must-Buy

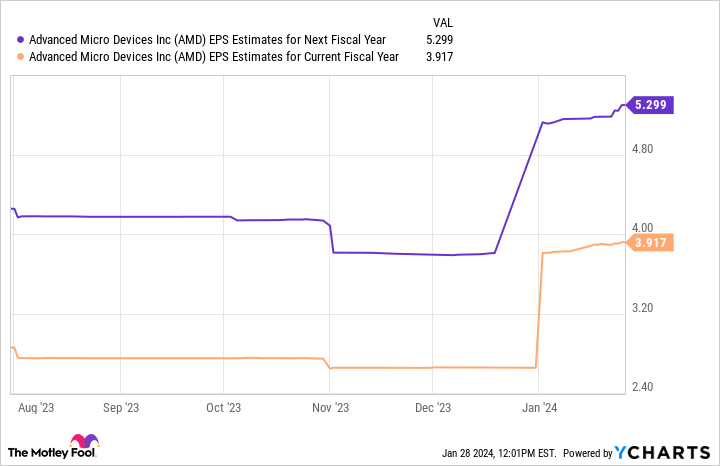

With its impressive earnings and growth potential, AMD’s stock is an attractive investment opportunity in 2024. Earnings-per-share estimates suggest that AMD’s stock could significantly outperform the S&P 500 by its next fiscal year. This is due in part to the company’s ability to carve out a lucrative role in the AI market, which is projected to expand at a compound annual growth rate of 37% through 2030.

The potential for triple-digit returns is a significant draw for investors, and AMD’s stock is well-positioned to deliver. With a forward price-to-earnings ratio of 45, AMD’s stock is undervalued compared to its peers. As the company continues to execute on its strategy and capitalize on the growing AI market, its stock price is likely to rise, providing investors with substantial returns.

The Future of AI: A $200 Billion Pie with Room for Growth

The AI Market’s Rapid Growth Rate: A $1 Trillion Opportunity

The AI market is projected to reach nearly $200 billion in 2023 and expand at a compound annual growth rate of 37% through 2030. This rapid growth rate presents a significant opportunity for companies like AMD, which are investing heavily in the AI sector. As the market continues to grow, AMD is well-positioned to capitalize on this trend and carve out a lucrative role in the AI market.

The implications for AMD’s stock are significant, as the company’s ability to execute on its AI strategy will have a direct impact on its stock price. With the AI market projected to surpass $1 trillion by the end of the decade, AMD’s stock has the potential to rise significantly as the company continues to grow its presence in the AI market.

AMD’s Growing Presence: A Strong Foundation for Future Growth

AMD’s role in the AI market is growing, with the company’s MI300X chip and partnership with Microsoft demonstrating its commitment to the sector. The MI300X chip is designed to compete with Nvidia’s H100 AI GPU, and AMD claims that it beats the H100 for inference by 10% to 20%. This is a significant achievement, as it demonstrates AMD’s ability to compete with the industry leader in AI GPUs.

AMD’s partnership with Microsoft is also a significant development, as it provides the company with a powerful ally in the AI market. Microsoft’s Azure platform will be the first cloud platform to implement AMD’s new GPU, optimizing its AI capabilities. This partnership has the potential to drive significant revenue growth for AMD, as Microsoft’s Azure platform is a leading cloud computing platform.

A Lucrative Future: The Implications for AMD’s Stock

The implications for AMD’s stock are significant, as the company’s growing presence in the AI market has the potential to drive significant revenue growth. With earnings-per-share estimates suggesting that AMD’s stock could significantly outperform the S&P 500 by its next fiscal year, the company’s stock is an attractive investment opportunity in 2024.

The potential for triple-digit returns is a significant draw for investors, and AMD’s stock is well-positioned to deliver. With a forward price-to-earnings ratio of 45, AMD’s stock is undervalued compared to its peers. As the company continues to execute on its strategy and capitalize on the growing AI market, its stock price is likely to rise, providing investors with substantial returns.

Conclusion

The Nvidia Opportunity: A Giant in the Making

In our recent article, “300 Billion Reasons to Buy Nvidia Before This Budding Business Becomes a Giant – The Motley Fool”, we delved into the vast potential of Nvidia, the tech giant behind the chipsets that power the world’s most advanced computers. We highlighted the company’s impressive track record of innovation, its dominant position in the artificial intelligence (AI) and graphics processing unit (GPU) markets, and its substantial cash reserves. The article argued that Nvidia’s stock is undervalued and poised for significant growth, with a market capitalization that could potentially reach $300 billion in the not-so-distant future.

The significance of Nvidia’s story cannot be overstated. As AI and computing technology continue to advance at breakneck speed, Nvidia is uniquely positioned to capitalize on the resulting demand for high-performance processing power. Its GPUs are the backbone of many AI applications, from autonomous vehicles to medical imaging, and its datacenter business is growing rapidly. Moreover, the company’s acquisition of Arm, a leading provider of chip designs, has given it a significant foothold in the burgeoning mobile market. As the world becomes increasingly digitized, Nvidia is well-positioned to reap the rewards.

Add Comment