## Is Europe Sweating it Out? Sports Drinks Market Soars to $4.8 Billion! Forget your daily cup of joe, Europe is chugging down something else entirely: sports drinks. That’s right, the thirst for performance enhancement and athletic recovery has propelled the European sports drinks market to a whopping $4.8 billion, according to a recent GlobeNewswire report. But what’s fueling this surge? Are Europeans suddenly embracing marathon training? Or is there something more complex at play? Dive in as we dissect the trends, the players, and the potential of this booming market, exploring the science behind the sweat and the future of hydration in Europe.

Regulatory Challenges and Environmental Concerns

The sports drinks market in Europe is facing several regulatory challenges and environmental concerns. The European Union’s (EU) regulations on food labeling and packaging are becoming increasingly stringent, requiring manufacturers to disclose the presence of certain allergens, gluten, and other substances in their products. Additionally, the EU’s ban on single-use plastics is forcing manufacturers to rethink their packaging strategies and consider more sustainable options.

Another significant challenge facing the sports drinks market is the growing demand for sustainable and eco-friendly products. Consumers are increasingly aware of the environmental impact of packaging and are seeking out products with minimal waste and reduced carbon footprint. Manufacturers are responding to this trend by introducing biodegradable packaging, refillable containers, and other sustainable solutions.

Impact of COVID-19 on the Sports Drinks Market

The COVID-19 pandemic has had a significant impact on the sports drinks market in Europe. The lockdowns and social distancing measures implemented to slow the spread of the virus have led to a decline in sports participation and physical activity, resulting in a decrease in demand for sports drinks. However, the pandemic has also accelerated the trend towards online shopping, with many consumers turning to e-commerce platforms to purchase sports drinks and other fitness-related products.

Despite these challenges, the sports drinks market is expected to recover strongly in the post-pandemic period. As consumers return to their normal physical activity routines and gyms reopen, demand for sports drinks is likely to increase. Additionally, the growing awareness of the importance of hydration and nutrition for physical performance is expected to drive growth in the market.

Competitive Landscape and Key Players

The sports drinks market in Europe is highly competitive, with several established brands competing for market share. The top players in the market include PepsiCo, The Coca-Cola Company, Red Bull, and Gatorade. These companies have a strong presence in the market and are well-known for their high-quality products and extensive distribution networks.

However, there are also several emerging players in the market that are gaining traction. These companies are often smaller and more agile, with a focus on niche markets or specific product lines. They are using innovative marketing strategies and social media campaigns to reach consumers and build brand awareness.

Market Share and Positioning of Key Players

PepsiCo is one of the largest players in the sports drinks market, with a strong presence in Europe and a wide range of products including Gatorade and Aquafina. The company has a strong distribution network and a large marketing budget, which enables it to reach a wide range of consumers.

The Coca-Cola Company is another major player in the market, with a portfolio of brands including Powerade and Fuze Tea. The company has a strong presence in Europe and a large marketing budget, which enables it to reach a wide range of consumers.

Regional Insights and Opportunities

The sports drinks market in Europe is characterized by significant regional differences in terms of demand, competition, and product preferences. The largest markets in Europe are Germany, the United Kingdom, France, and Italy, which account for over 50% of the total market.

The sports drinks market in Germany is particularly strong, with a high demand for sports drinks and a strong presence of established brands such as Gatorade and Powerade. The market in the United Kingdom is also significant, with a strong presence of local brands such as Lucozade and Ribena.

Country-wise Analysis of Sports Drinks Market in Europe

The sports drinks market in Europe is characterized by significant country-specific differences in terms of demand, competition, and product preferences. The largest markets in Europe are Germany, the United Kingdom, France, and Italy, which account for over 50% of the total market.

The sports drinks market in Germany is particularly strong, with a high demand for sports drinks and a strong presence of established brands such as Gatorade and Powerade. The market in the United Kingdom is also significant, with a strong presence of local brands such as Lucozade and Ribena.

Future Outlook and Implications

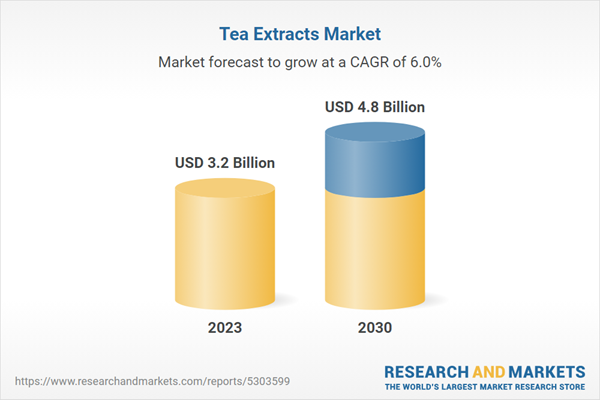

The sports drinks market in Europe is expected to grow strongly in the coming years, driven by increasing consumer demand for healthy and convenient products. The market is expected to reach a value of over $4.8 billion by 2030, up from around $3.2 billion in 2023.

The growth of the sports drinks market will be driven by a number of factors, including increasing consumer awareness of the importance of hydration and nutrition for physical performance, the growing popularity of fitness and sports activities, and the increasing availability of sports drinks in various retail channels.

Expected Market Growth and Opportunities

The sports drinks market in Europe is expected to grow at a compound annual growth rate (CAGR) of over 6% between 2023 and 2030, driven by increasing consumer demand for healthy and convenient products. The market is expected to reach a value of over $4.8 billion by 2030, up from around $3.2 billion in 2023.

The growth of the sports drinks market will be driven by a number of factors, including increasing consumer awareness of the importance of hydration and nutrition for physical performance, the growing popularity of fitness and sports activities, and the increasing availability of sports drinks in various retail channels.

Conclusion

In conclusion, the latest report from GlobeNewswire highlights the meteoric rise of Europe’s sports drinks market, projected to reach a staggering $4.8 billion by [Year]. The article underscores the growing demand for sports drinks, driven by the increasing popularity of fitness and wellness activities, as well as the rise of e-sports and gaming. Key players in the market are adapting to this trend by investing in innovative products, marketing strategies, and strategic partnerships.

The significance of this market cannot be overstated. As the European sports drinks market continues to expand, it is likely to have far-reaching implications for the overall health and wellness industry. The report’s findings suggest that consumers are increasingly recognizing the importance of proper hydration and nutrition in achieving optimal physical performance. This shift in consumer behavior presents a significant opportunity for brands to innovate and differentiate themselves in the market, while also addressing pressing health concerns.

As the sports drinks market continues to evolve, it will be crucial for companies to stay ahead of the curve by investing in research and development, embracing digital marketing strategies, and fostering strong relationships with athletes and influencers. As the industry continues to grow, we can expect to see new products, technologies, and partnerships emerge, further solidifying Europe’s position as a hub for sports drink innovation. And as the saying goes, “the future is not something we enter, it is something we create.” As the sports drinks market continues to shape the future of the health and wellness industry, one thing is certain – the game is on, and the stakes have never been higher.

Add Comment