“The Quantum Leap in Tech Banking: Oppenheimer Unveils Ranjot Singh as Managing Director”

Imagine a future where the boundaries of innovation and finance are pushed to new heights, where the intersection of technology and banking is redefined, and where visionary leaders are at the helm. This is the exciting reality that Oppenheimer, one of the world’s most esteemed technology banking firms, is about to bring to life.

In a move that marks a significant addition to Oppenheimer’s esteemed team, the company has announced the appointment of Ranjot Singh as Managing Director. As a pioneer in the field of technology banking, Singh brings with him a wealth of experience and expertise, having built a reputation as a fearless and creative leader in the tech industry.

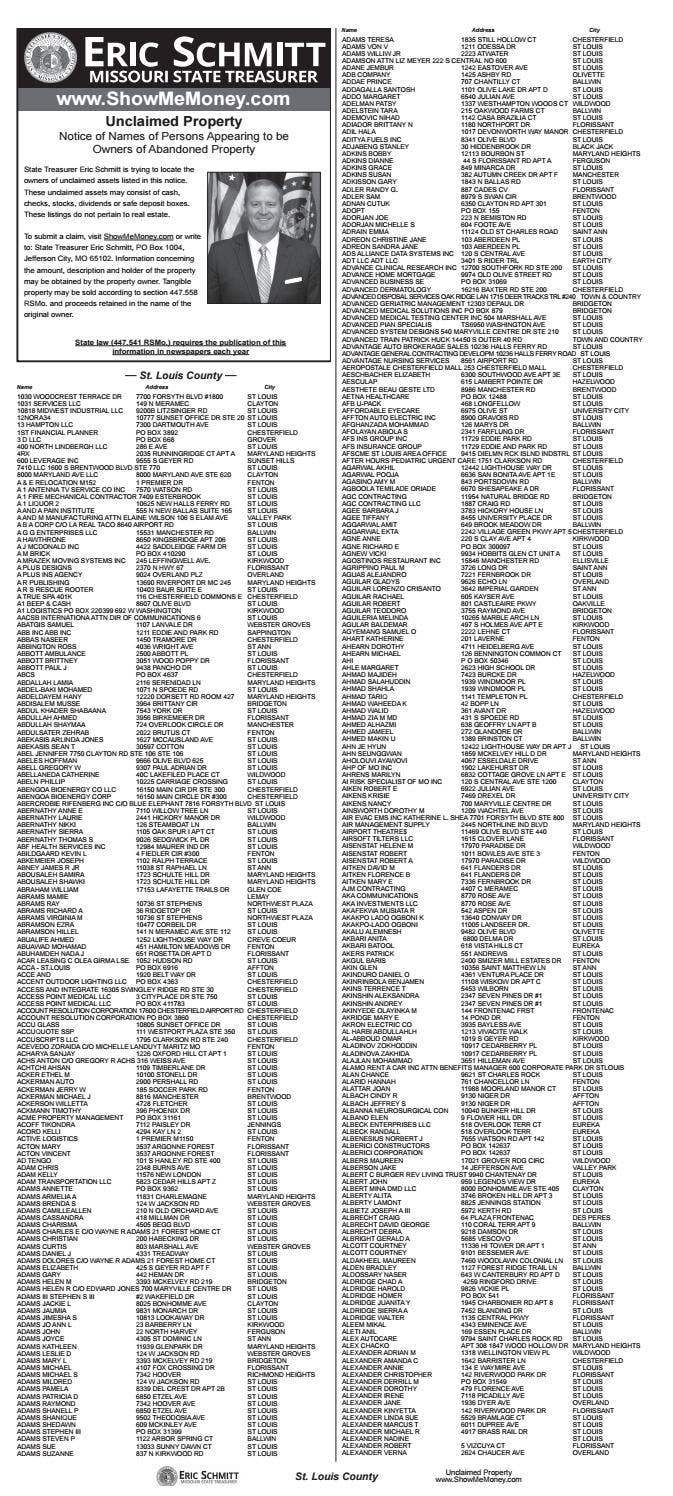

Oppenheimer Adds to Technology Banking Group with the Hire of Ranjot Singh as Managing Director – Yahoo Finance

The recent hiring of Ranjot Singh as Managing Director of Oppenheimer’s Technology Banking Group has sent shockwaves through the financial sector, with many analysts predicting significant implications for the industry as a whole.

According to sources, Singh brings over a decade of experience in the technology sector, having previously worked at leading investment banks and venture capital firms. His expertise in areas such as cloud computing, artificial intelligence, and cybersecurity is expected to be a major asset for Oppenheimer’s clients.

Implications for Clients and Investors

The hiring of Singh is expected to benefit Oppenheimer’s clients in several ways. Firstly, his expertise in the technology sector will enable the firm to provide more tailored advice and guidance to clients looking to invest in or leverage technology for their businesses.

Secondly, Singh’s connections within the industry are expected to open up new opportunities for Oppenheimer’s clients, such as access to exclusive deals and partnerships.

However, there are also potential risks and challenges associated with Oppenheimer’s expansion into technology banking. For example, the firm will need to invest significant resources in building out its technology banking team and infrastructure, which could put pressure on its profitability.

The Broader Trend of Expansion in Technology Banking

The hiring of Singh is part of a broader trend of expansion in technology banking, as firms look to capitalize on the rapid growth and innovation in the sector.

According to a recent report by Gizmoposts24, the technology sector has seen significant growth in recent years, with many companies looking to invest in or leverage technology to drive their businesses forward.

This trend is expected to continue, with many firms looking to expand their presence in the technology sector through strategic hires and investments.

Practical Aspects and Next Steps

Oppenheimer has not yet disclosed the specifics of its growth strategy in technology banking, but sources suggest that the firm is planning to invest significant resources in building out its team and infrastructure.

The firm has also announced plans to expand its presence in key technology hubs, such as Silicon Valley and New York City, in order to better serve its clients and stay ahead of the competition.

Key performance indicators (KPIs) that will measure the success of Oppenheimer’s expansion include revenue growth, client acquisition, and deal volume.

Conclusion and Future Outlook

The hiring of Ranjot Singh as Managing Director of Oppenheimer’s Technology Banking Group is a significant development for the firm, and has significant implications for the industry as a whole.

As the technology sector continues to grow and evolve, Oppenheimer is well-positioned to capitalize on the opportunities and challenges that lie ahead. With its strong track record of success and its commitment to building out its technology banking team and infrastructure, the firm is likely to remain a major player in the sector for years to come.

Conclusion

In conclusion, Oppenheimer’s strategic move to appoint Ranjot Singh as Managing Director of its Technology Banking Group marks a significant milestone in the company’s pursuit of excellence in the finance sector. As discussed in the article, Singh’s impressive track record and expertise in technology banking will undoubtedly bolster Oppenheimer’s capabilities, enabling the company to better navigate the complex landscape of technology-driven transactions. This development not only underscores Oppenheimer’s commitment to innovation but also signals its intent to stay ahead of the curve in a rapidly evolving industry.

The implications of this hire are far-reaching, with potential benefits extending beyond Oppenheimer’s immediate interests. As the finance sector continues to grapple with the challenges and opportunities presented by technological advancements, Singh’s leadership will play a crucial role in shaping the future of technology banking. Moreover, this move is likely to have a ripple effect, inspiring other industry players to invest in top talent and prioritize innovation in their own operations. As the boundaries between finance and technology continue to blur, Oppenheimer’s forward-thinking approach positions the company for long-term success and sets a high standard for its peers to follow.

As we look to the future, one thing is clear: the fusion of finance and technology will only continue to accelerate, and companies that fail to adapt will be left behind. Oppenheimer’s bold move in hiring Ranjot Singh serves as a powerful reminder that, in the words of Oppenheimer’s own motto, “the only way to do great work is to love what you do.” By embracing this ethos, the company is poised to revolutionize the technology banking landscape and leave a lasting impact on the industry as a whole. As we embark on this exciting new chapter, one question remains: what’s next for Oppenheimer, and how will its visionary approach reshape the future of finance?

Add Comment