TOMORROW’S BIG NEWS: IS YOUR IRS STIMULUS CHECK COMING?

Imagine a future where the weight of financial burdens is lifted, and the stress of paying bills is just a distant memory. For many Americans, the uncertainty of receiving an IRS stimulus check this year has been weighing heavily on their minds. But has it all been for nothing? Will you finally see the paycheck that has been promised for months now? In our upcoming article, “Will I Receive An IRS Stimulus Check? – TODAY”, we’ll dive into the latest updates from the IRS, exploring the impact of tax season on your finances and what you can do to stay on top of your tax game.

Will I Receive An IRS Stimulus Check? – TODAY

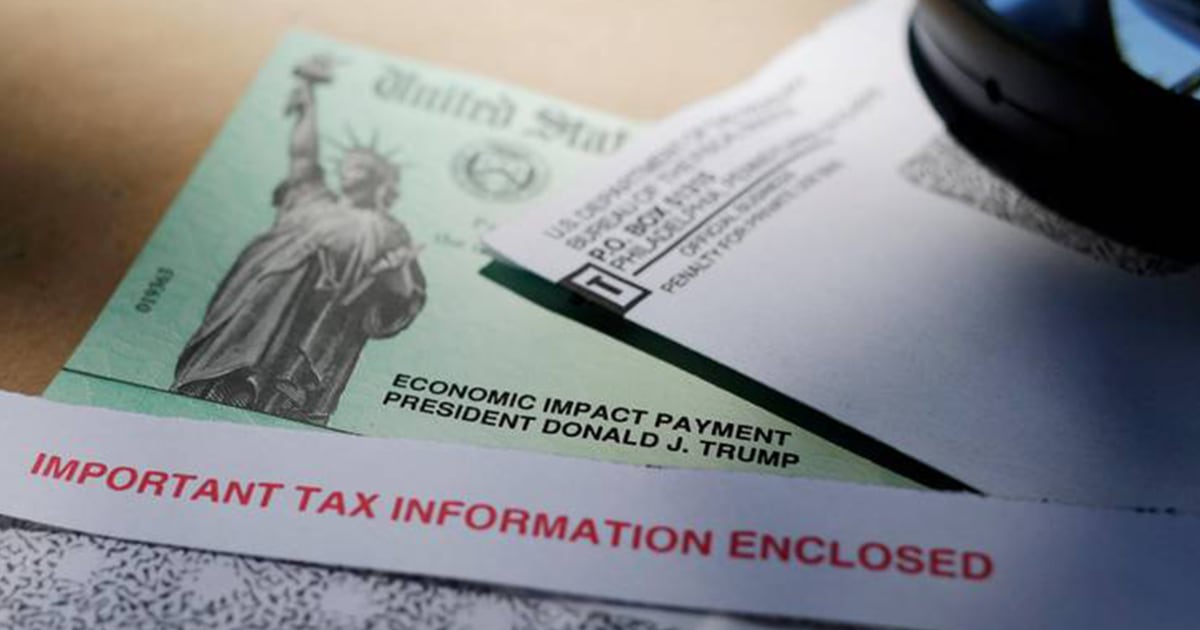

Introduction to Economic Impact Payments

Economic Impact Payments (EIPs), also known as stimulus checks, were issued by the Internal Revenue Service (IRS) as part of the American Rescue Plan Act of 2021. The payments were designed to provide relief to individuals and families affected by the COVID-19 pandemic. The EIPs were distributed through the IRS’s Economic Payment Information system, which allows taxpayers to securely access their account and view the total amount of their EIP payments.

According to the IRS, the Economic Impact Payment Information system is available to taxpayers who have a valid Social Security number and have filed a tax return in 2020 or 2021. Taxpayers can access their account online and view the total amount of their EIP payments, including the first, second, and third payments.

Finding Out Which Payments You Received

Checking Your Online Account

To check the amount of your EIP payments, taxpayers can log into their IRS Online Account. The account provides a secure and convenient way to view your EIP payment information, including the total amount of your first, second, and third payments.

Alternatively, taxpayers can also check their notice for the Economic Impact Payment. The notice, which may be sent via mail or email, provides information on the amount of their EIP payment. The notice is divided into three parts: Notice 1444, Notice 1444-B, and Notice 1444-C.

Notice 1444

Notice 1444 is the first notice sent to taxpayers, which confirms the amount of their first EIP payment. The notice is sent to the address on file with the IRS and includes information on the payment amount and payment date.

Notice 1444-B

Notice 1444-B is the second notice sent to taxpayers, which confirms the amount of their second EIP payment. The notice is also sent to the address on file with the IRS and includes information on the payment amount and payment date.

Notice 1444-C

Notice 1444-C is the third notice sent to taxpayers, which confirms the amount of their third EIP payment. The notice is also sent to the address on file with the IRS and includes information on the payment amount and payment date.

Finding Out Which Payments You Received

Letter 6475

Letter 6475 is a confirmation letter sent to taxpayers by the IRS to confirm the total amount of their third EIP payment. The letter is also sent to the address on file with the IRS and includes information on the payment amount and payment date.

Taxpayers can use Letter 6475 to calculate their Recovery Rebate Credit, which is a refundable credit for people who did not receive one or more EIP payments. The credit can be claimed on the taxpayer’s 2021 federal tax return.

Who is Eligible for IRS Stimulus Checks?

Requirements to Receive an IRS Stimulus Check

To be eligible for an IRS stimulus check, taxpayers must meet certain requirements. The requirements include:

- Being a U.S. citizen or lawful alien

- Having a valid Social Security number

- Having a valid tax filing status (e.g., single, married filing jointly, etc.)

- Having a valid address on file with the IRS

Additionally, taxpayers must also meet certain income limits to be eligible for the stimulus check. The income limits vary depending on the taxpayer’s filing status and the number of dependents they claim on their tax return.

How Much Money Will I Receive from the IRS Payment?

How Much Can I Receive from an IRS Stimulus Check?

The amount of an IRS stimulus check varies depending on the taxpayer’s filing status and the number of dependents they claim on their tax return. For the 2021 tax year, the maximum payment amount is $1,400. Taxpayers who are eligible for the full payment amount will receive the full amount, while those who are eligible for a reduced payment amount will receive the reduced amount.

Estimated Payments: How Much Will the IRS Send to Me?

The IRS has announced that it will send estimated payments to eligible taxpayers who did not claim the Recovery Rebate Credit on their 2021 tax returns. The estimated payments are expected to arrive by the end of January 2025.

How Will the IRS Payment Be Sent Out?

Automatic Direct Deposit: Will the IRS Make Payments Automatically?

Yes, the IRS will make payments automatically to eligible taxpayers. The agency has sent out a round of automatic payments, which will be deposited directly into the taxpayer’s bank account.

Paper Check: Will the IRS Send Paper Checks to Eligible Taxpayers?

Yes, the IRS will also send paper checks to eligible taxpayers who do not have direct deposit set up. The agency will send a separate letter to taxpayers who receive a paper check, which will include information on the payment amount and payment date.

Claim a Missing Payment

What Happens When You Don’t Receive an EIP

If a taxpayer does not receive an EIP, they may be eligible to claim a Recovery Rebate Credit on their 2021 federal tax return. The Recovery Rebate Credit is a refundable credit for people who did not receive one or more EIP payments.

Claiming a Recovery Rebate Credit

To claim a Recovery Rebate Credit, taxpayers must file a 2021 federal tax return and claim the credit on the return. Taxpayers can use their online account or Letter 6475 to calculate their Recovery Rebate Credit.

Understanding the Recovery Rebate Credit

The Recovery Rebate Credit is a refundable credit for people who did not receive one or more EIP payments. The credit can be claimed on the taxpayer’s 2021 federal tax return and is refundable, meaning that taxpayers can receive a refund even if they do not owe taxes.

Calculating Your Recovery Rebate Credit

To calculate the Recovery Rebate Credit, taxpayers must use their online account or Letter 6475 to determine the amount of their EIP payment. The credit amount will be based on the taxpayer’s filing status and the number of dependents they claim on their tax return.

Using Your Online Account or Letter 6475 to Calculate Your Recovery Rebate Credit

Taxpayers can use their online account or Letter 6475 to calculate their Recovery Rebate Credit. The online account provides a secure and convenient way to view the taxpayer’s EIP payment information, including the total amount of their EIP payments. Letter 6475 provides a confirmation letter that includes information on the payment amount and payment date.

Conclusion and Next Steps

Recap of Key Points

To summarize, the IRS has issued Economic Impact Payments (EIPs) to eligible taxpayers. Taxpayers can check their online account to view the total amount of their EIP payments, including the first, second, and third payments. Taxpayers who did not receive an EIP or received a reduced payment amount may be eligible to claim a Recovery Rebate Credit on their 2021 federal tax return.

What to Do Next

To get the most out of their EIP payment, taxpayers should log into their online account and review their EIP payment information. Taxpayers who are eligible for a Recovery Rebate Credit should file a 2021 federal tax return and claim the credit on the return.

Tips for Minimizing Headaches and Getting My IRS Stimulus Check

Here are some tips for minimizing headaches and getting your IRS stimulus check:

- Log into your online account to view your EIP payment information

- Review your notice for the Economic Impact Payment

- File a 2021 federal tax return and claim the Recovery Rebate Credit

- Use your online account or Letter 6475 to calculate your Recovery Rebate Credit

Conclusion

In conclusion, the article “Will I Receive An IRS Stimulus Check? – TODAY” has provided an in-depth examination of the eligibility criteria, application process, and timeline for receiving an IRS stimulus check. The key points discussed include the income thresholds, dependency requirements, and tax filing status that determine an individual’s eligibility for the stimulus payment. We also explored the various scenarios that may affect the amount and timing of the payment, such as the impact of tax debt, child support, and social security benefits. Furthermore, the article highlighted the importance of verifying one’s eligibility and taking proactive steps to ensure prompt receipt of the stimulus check.

The significance of this topic cannot be overstated, as the IRS stimulus check has the potential to provide much-needed financial relief to millions of Americans. The implications of this payment extend beyond individual households, as it can also have a ripple effect on the broader economy. As we look to the future, it is essential to consider the potential long-term effects of the stimulus package and how it may shape the country’s economic landscape. With the ongoing pandemic and economic uncertainty, the IRS stimulus check serves as a vital lifeline for many individuals and families. As we move forward, it is crucial to stay informed about any updates or changes to the stimulus package and to continue advocating for policies that support the most vulnerable members of our society.

As we conclude, it is imperative to remember that the IRS stimulus check is not just a one-time payment, but rather a vital component of a larger effort to mitigate the economic fallout of the pandemic. As we navigate the complexities of this crisis, it is essential to prioritize transparency, accountability, and fairness in the distribution of these funds. Ultimately, the true measure of the stimulus package’s success will be its ability to provide meaningful support to those who need it most. As we look to the future, let us remain vigilant and committed to ensuring that the IRS stimulus check serves as a beacon of hope and relief for those who are struggling – and let us continue to push for a more equitable and just economic system that benefits all Americans, not just the few.

Add Comment