## Trump’s Towering Claims, Gillian Tett’s Sobering Reality Check: Remember those roaring rallies, the “Make America Great Again” chants, the promises of booming markets and a golden age for the American worker? Trump’s economic narrative painted a picture of unparalleled prosperity, fueled by tax cuts and deregulation. But what did the real numbers tell us? Gillian Tett, the Financial Times’ sharp-eyed columnist and master interpreter of financial landscapes, peels back the gilded curtain. Get ready to step into a world where economic realities clash with political spin, and discover the true impact of Trump’s economic policies – a story that goes far beyond the headlines.

The Illusion of Risk Elimination: The Seeds of a Financial Tsunami

The Trump Connection: Boom, Bust, and the Lingering Legacy

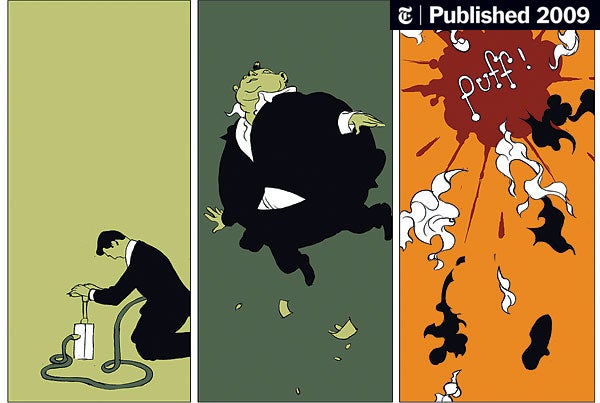

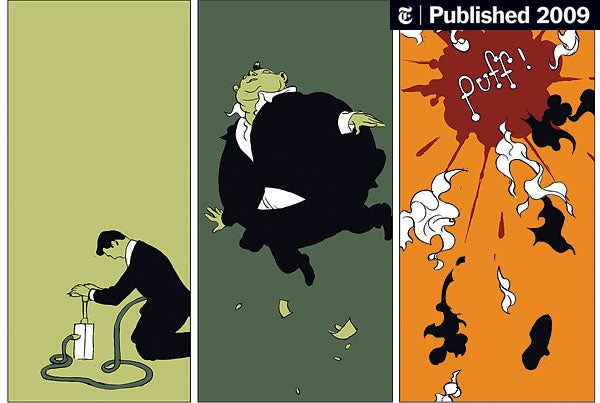

The financial system, under the Trump administration, seemed to hum with a strange, almost manic energy. While pronouncements of economic triumph echoed through the halls of power, a shadow loomed beneath the surface: an intricate web of credit derivatives, complex financial instruments that promised to eliminate risk but ultimately sowed the seeds of a potential financial tsunami. The story of how these derivatives, fueled by the intoxicating allure of risk elimination, played a pivotal role in shaping the Trump-era economy is a cautionary tale of hubris, deregulation, and the fragility of a system built on increasingly opaque financial structures.

As Gillian Tett, a columnist and member of the editorial board for the Financial Times, meticulously reveals in her incisive analysis, the Trump administration’s policies, though seemingly focused on stimulating growth, inadvertently empowered the very forces that had orchestrated the 2008 financial crisis. Tett, a seasoned financial journalist with an enviable track record, delves into the labyrinthine world of derivatives, tracing their evolution from relatively simple contracts to highly sophisticated instruments that obscured risk rather than mitigating it.

Tett’s Analysis: How Did Trump’s Policies Impact the Derivative World?

Tett argues that the Trump administration’s rollback of financial regulations, implemented under the banner of deregulation and “freeing the market,” created a fertile ground for the unchecked growth of derivatives. These policies, she posits, emboldened financial institutions to engage in increasingly risky practices, driven by the allure of short-term profits and the belief that any potential losses could be readily absorbed by the market. The sheer complexity of these derivatives, often layered upon layers of interconnected contracts, made it difficult for regulators to fully understand the systemic risks they posed. Tett’s analysis highlights the inherent tension between deregulation and financial stability, exposing the dangerous consequences of loosening the reins on a system already prone to volatility.

The Ripple Effects: Did Derivatives Play a Role in the 2008 Crisis and Beyond?

The 2008 financial crisis, a stark reminder of the devastating consequences of unchecked risk-taking, served as a backdrop to Tett’s investigation. While the immediate triggers of the crisis were rooted in the subprime mortgage market, Tett’s analysis reveals the insidious role played by derivatives in exacerbating the fallout. Credit default swaps, a type of derivative designed to insure against loan defaults, became entangled in a web of interconnected transactions, ultimately leading to a cascade of failures as the value of these swaps plummeted. Tett contends that the widespread use of derivatives, coupled with a lack of transparency and regulatory oversight, created a perfect storm that amplified the impact of the crisis, sending shockwaves through the global financial system.

The Real Impact: Beyond the Balance Sheet

The Human Cost: Exploring the Social and Economic Impacts of Derivative-Fueled Crises

While the intricacies of derivatives may seem confined to the realm of high finance, their impact extends far beyond balance sheets and Wall Street boardrooms. Tett underscores the profound human cost of derivative-fueled crises, revealing how these financial upheavals translate into real-world consequences for ordinary people. Job losses, foreclosures, and economic hardship become the stark realities for those caught in the crosshairs of a system that often prioritizes profits over people.

Regulating the Invisible Hand: The Need for Increased Transparency and Oversight

Tett’s analysis calls for a renewed focus on financial regulation, emphasizing the need for greater transparency and oversight in the world of derivatives. She argues that the complexity of these instruments necessitates a regulatory framework that can effectively monitor and mitigate systemic risks. Tett advocates for stronger prudential regulations, enhanced disclosure requirements, and increased scrutiny of the activities of financial institutions that deal extensively in derivatives. She contends that a robust regulatory framework is essential to safeguarding the financial system and protecting the interests of investors and consumers alike.

A Call for Sustainable Finance: Can We Build a More Resilient Financial System?

Looking ahead, Tett explores the need for a paradigm shift in finance, urging for the development of a more sustainable and resilient financial system. She calls for a move away from short-term profit maximization and towards a system that prioritizes long-term value creation and environmental sustainability. Tett argues that a truly resilient financial system must be one that is able to withstand shocks, adapt to changing conditions, and promote both economic prosperity and social well-being.

Conclusion

So, there you have it. Gillian Tett’s analysis paints a complex, and perhaps unsettling, picture of the real impact of Trump’s economic policies. While headline numbers might point to a booming economy, the reality is a story of widening inequality, vulnerable industries, and a looming debt crisis. Tett argues that the focus on short-term gains has come at a significant cost, potentially jeopardizing long-term stability and sustainability. This isn’t just an academic debate; it’s a stark warning about the hidden dangers of prioritizing immediate gratification over responsible economic stewardship.

Add Comment