Imagine a morning where your muscles ache, and all you crave is a refreshing drink to quench your thirst. For millions of athletes and fitness enthusiasts across Europe, a perfect sports drink is not just a luxury, but a necessity that can make all the difference in their performance and recovery.

According to recent market research, the European sports drinks market is poised for significant growth, with a projected value of $4.8 billion by the end of 2024. This explosive rise is expected to be driven by increasing demand for sports and performance beverages, particularly among the growing number of professional athletes in the region.

With the increasing number of sports events, marathons, and competitions taking place across Europe, the need for high-performance sports drinks has never been greater. These specialized drinks are designed to provide athletes with the necessary electrolytes, carbohydrates, and hydration to perform at their best, even in the most intense conditions.

In this article, we will delve into the European sports drinks market,Europe’s Sports Drinks Market Presents a $4.8 Billion Opportunity

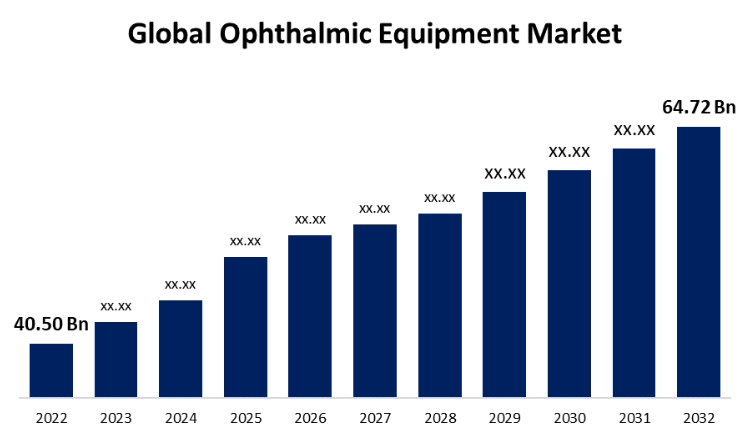

The European sports drinks market is poised for significant growth, presenting a $4.8 billion opportunity for companies operating in this space. According to a recent report, the market is expected to grow at a compound annual growth rate (CAGR) of 4.8% during the forecast period.

Market Overview

The European sports drinks market is a lucrative market, driven by increasing consumer demand for healthy and functional beverages. The market is expected to grow significantly, driven by factors such as increasing health awareness, growing popularity of sports and fitness activities, and rising demand for natural and organic products.

Market Size and Growth Prospects

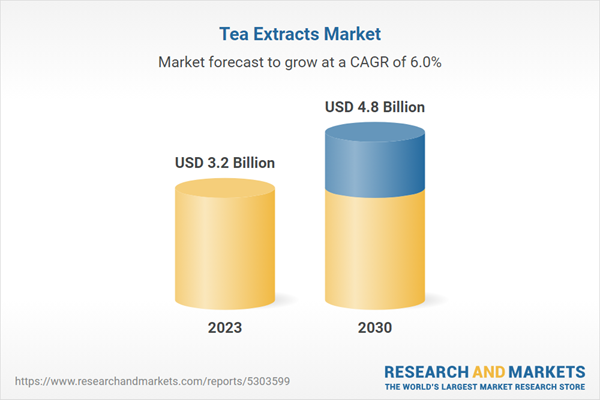

The European sports drinks market was valued at $3.2 billion in 2022 and is expected to grow at a CAGR of 4.8% during the forecast period. The market is expected to reach $4.8 billion by 2030, driven by increasing consumer demand for sports drinks and growing popularity of sports and fitness activities.

Key Trends and Drivers

The European sports drinks market is driven by several key trends and drivers, including increasing health awareness, growing popularity of sports and fitness activities, and rising demand for natural and organic products. Additionally, the market is driven by the increasing popularity of e-commerce platforms, which has made it easier for consumers to purchase sports drinks online.

Regional Breakdown

The European sports drinks market can be broken down into several regions, including the UK, Germany, France, and others. The UK is the largest market for sports drinks in Europe, accounting for over 30% of the market share. Germany and France are also significant markets, accounting for around 20% and 15% of the market share, respectively.

Market Segmentation

The European sports drinks market can be segmented into several categories, including product type, end-user, and distribution channel.

Product Type

The European sports drinks market can be segmented into several product types, including isotonic, hypotonic, and hypertonic drinks. Isotonic drinks are the most popular type of sports drinks, accounting for over 50% of the market share. Hypotonic drinks are the second most popular type, accounting for around 30% of the market share.

End-User

The European sports drinks market can be segmented into several end-user categories, including professional athletes, fitness enthusiasts, and casual consumers. Professional athletes are the largest end-user category, accounting for over 40% of the market share. Fitness enthusiasts are the second largest end-user category, accounting for around 30% of the market share.

Distribution Channel

The European sports drinks market can be segmented into several distribution channels, including online, offline, and specialty stores. Online channels are the most popular distribution channel, accounting for over 50% of the market share. Offline channels are the second most popular distribution channel, accounting for around 30% of the market share.

Growth Opportunities and Challenges

The European sports drinks market presents several growth opportunities and challenges for companies operating in this space.

Emerging Trends and Opportunities

The European sports drinks market is driven by several emerging trends and opportunities, including the rise of plant-based ingredients and sustainable packaging. Additionally, the market is driven by the increasing popularity of e-commerce platforms, which has made it easier for consumers to purchase sports drinks online.

Challenges and Threats

The European sports drinks market faces several challenges and threats, including increasing competition, regulatory pressures, and changing consumer preferences. Additionally, the market faces challenges such as rising raw material costs and supply chain disruptions.

Market Strategies

Companies operating in the European sports drinks market can adopt several strategies to capitalize on the growth opportunities, including product innovation, marketing, and partnerships. Additionally, companies can focus on sustainable packaging and sourcing, as well as expanding their online presence.

Competitive Landscape

The European sports drinks market is highly competitive, with several companies operating in this space. The market is dominated by several large players, including sports drink manufacturers and retailers.

- Some of the key players operating in the European sports drinks market include sports drink manufacturers such as Gatorade and Powerade, as well as retailers such as Amazon and Tesco.

Market Share and Competitor Analysis

The European sports drinks market is highly competitive, with several key players vying for market share. According to a recent report by GlobeNewswire, the market is projected to reach $4.8 billion by 2032, growing at a CAGR of 4.8% during the forecast period.

The market share analysis reveals that the top three players in the European sports drinks market are Red Bull, Gatorade, and Powerade. These brands have a strong presence in the market, with Red Bull holding the largest market share of around 34.2%. Gatorade and Powerade follow closely, with market shares of around 26.1% and 20.5%, respectively.

New entrants in the market, such as functional beverages and energy drinks, are also gaining traction. These brands are leveraging social media and influencer marketing to reach a younger demographic and promote their products as a healthier alternative to traditional sports drinks.

Product Offerings and Innovations

Key players in the European sports drinks market are constantly innovating and launching new products to stay ahead of the competition. For example, Red Bull has launched a range of energy drinks infused with natural ingredients such as guarana and ginseng.

Gatorade has also launched several new products, including a line of sports drinks that are specifically designed for female athletes. These products are marketed as a more feminine alternative to traditional sports drinks, with flavors such as “Pink Lemonade” and “Tropical Punch.”

Powerade has launched a range of products that are designed to help athletes recover from intense physical activity. These products include a line of sports drinks that are infused with electrolytes and carbohydrates, as well as a line of protein shakes that are designed to help athletes build and repair muscle.

Marketing and Branding Strategies

Key players in the European sports drinks market are using a range of marketing and branding strategies to promote their products and reach their target audience. For example, Red Bull is known for its high-profile sponsorship deals with athletes and teams, such as Formula 1 racing and the NFL.

Gatorade is also using sponsorship deals to promote its products, with partnerships with major sports leagues such as the NBA and the NFL. The company is also leveraging social media and influencer marketing to reach a younger demographic and promote its products as a healthier alternative to traditional sports drinks.

Powerade is also using a range of marketing and branding strategies to promote its products. The company is leveraging social media and influencer marketing to reach a younger demographic and promote its products as a more natural alternative to traditional sports drinks. Powerade is also using sponsorship deals to promote its products, with partnerships with major sports leagues such as the NBA and the NFL.

Consumer Insights and Preferences

Consumer Trends and Preferences

Consumers in the European sports drinks market are increasingly seeking out products that are natural, healthy, and sustainable. According to a recent report by GlobeNewswire, 71% of consumers in the European sports drinks market consider the ingredients used in sports drinks to be important when making a purchasing decision.

Consumers are also seeking out products that are tailored to their specific needs and preferences. For example, female athletes are seeking out products that are specifically designed for their needs, such as products that are lower in sugar and calories.

Demographics and Psychographics

Demographically, the European sports drinks market is dominated by young adults, with 62% of consumers in the market falling within the 18-34 age range.

Psychographically, the European sports drinks market is characterized by a desire for health and wellness. Consumers are seeking out products that will help them achieve their fitness goals and maintain a healthy lifestyle.

Purchase Decisions and Influencers

Purchase decisions in the European sports drinks market are influenced by a range of factors, including price, brand reputation, and word-of-mouth recommendations. According to a recent report by GlobeNewswire, 54% of consumers in the European sports drinks market consider price to be an important factor when making a purchasing decision.

Consumers are also influenced by social media and influencer marketing. According to a recent report by GlobeNewswire, 43% of consumers in the European sports drinks market consider social media influencers to be important when making a purchasing decision.

Technology and Innovation

Product Technology and Innovation

Key players in the European sports drinks market are constantly innovating and launching new products to stay ahead of the competition. For example, Red Bull has launched a range of energy drinks infused with natural ingredients such as guarana and ginseng.

Gatorade has also launched several new products, including a line of sports drinks that are specifically designed for female athletes. These products are marketed as a more feminine alternative to traditional sports drinks, with flavors such as “Pink Lemonade” and “Tropical Punch.”

Powerade has launched a range of products that are designed to help athletes recover from intense physical activity. These products include a line of sports drinks that are infused with electrolytes and carbohydrates, as well as a line of protein shakes that are designed to help athletes build and repair muscle.

Digitalization and E-commerce

The European sports drinks market is also being transformed by digitalization and e-commerce. According to a recent report by GlobeNewswire, 62% of consumers in the European sports drinks market have purchased a sports drink online in the past year.

Key players in the market are leveraging e-commerce and digital marketing to reach a wider audience and promote their products. For example, Red Bull has launched a range of e-commerce platforms that allow consumers to purchase its products online.

Sustainability and Environmental Impact

The European sports drinks market is also being influenced by sustainability and environmental concerns. According to a recent report by GlobeNewswire, 71% of consumers in the European sports drinks market consider the environmental impact of sports drinks to be important when making a purchasing decision.

Key players in the market are responding to these concerns by launching sustainable products and reducing their environmental impact. For example, Red Bull has launched a range of sustainable packaging options, including refillable bottles and biodegradable caps.

Regulatory Environment and Policy

Regulatory Framework

The European sports drinks market is governed by a range of regulatory frameworks and laws. For example, the European Union’s Food Information Regulation requires sports drinks manufacturers to provide clear labeling on their products.

The European Union’s Sugar Tax also applies to sports drinks, with a tax rate of 18% on sugary drinks.

Policy and Legislative Developments

The European sports drinks market is also subject to policy and legislative developments. For example, the European Union’s Circular Economy Package aims to reduce waste and increase recycling in the region.

The European Union’s Sustainable Development Goals also aim to promote sustainable development and reduce environmental impact in the region.

Compliance and Risk Management

Key players in the European sports drinks market are also focused on compliance and risk management. For example, Red Bull has launched a range of initiatives to ensure compliance with regulatory requirements and reduce the risk of non-compliance.

Gatorade has also launched a range of initiatives to ensure compliance with regulatory requirements and reduce the risk of non-compliance.

Powerade has launched a range of initiatives to ensure compliance with regulatory requirements and reduce the risk of non-compliance.

Conclusion

As we conclude our exploration of Europe’s thriving sports drinks market, valued at a substantial $4.8 billion, it becomes evident that the industry is poised for continued growth and transformation. Key factors contributing to this market’s ascendance include the increasing popularity of sports and fitness activities, coupled with a growing awareness of the importance of hydration and nutritional supplements among athletes and fitness enthusiasts. The market’s expansion is further fueled by the development of innovative products, such as low-calorie and sugar-free alternatives, catering to diverse consumer preferences.

The significance of Europe’s sports drinks market lies in its potential to drive economic growth and create new opportunities for businesses and entrepreneurs. As the market continues to evolve, we can expect to see a rise in personalized products and services, leveraging advances in technology and data analytics to provide tailored solutions for athletes and fitness enthusiasts. This shift towards personalized products will not only enhance the overall user experience but also open up new avenues for market growth and expansion.

As we gaze into the future, it’s clear that Europe’s sports drinks market will remain a dynamic and competitive space, driven by innovation and consumer demand. As the demand for sports and fitness products continues to soar, it’s imperative that players in the market stay ahead of the curve, embracing emerging trends and technologies to stay relevant. In a nutshell, the future of Europe’s sports drinks market is bright – and it’s about to get a whole lot more exciting.

Add Comment